Sample pf withdrawal form 15g filled pdf

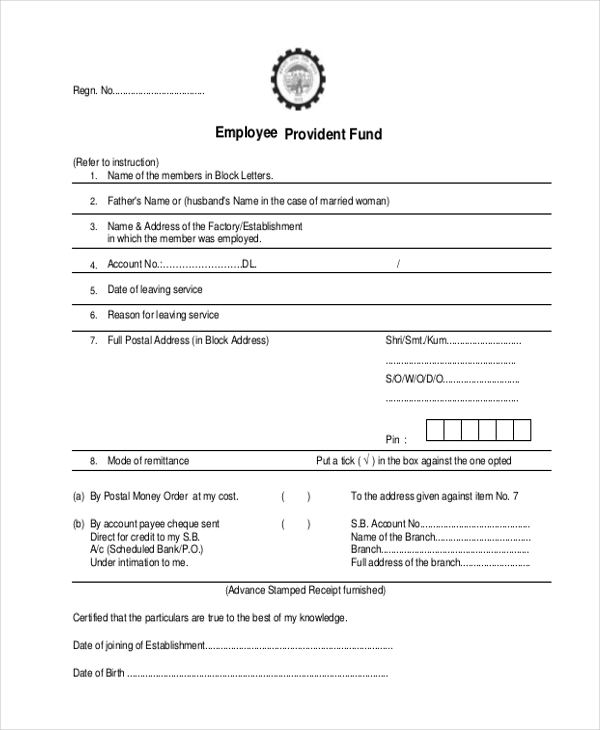

How To Fill Pf Withdrawal Form 19 And 10c Sample Sample filled employee provident fund (EPF) form 19 and pension form 10. April 27, 2015 / AGB. Do you need help in filling the form 19 and form 10 as part of employee provident fund

Sample Filled Pf Withdrawal Form 10c Please find attached the PF withdrawal form to be filled & couriered to below For your ease to fill the form we are also attaching a sample copy of the filed PF form.

Form No.15G during the same quarter, please allot separate series of serial number for Form No.15H and Form No.15G. 10 The person responsible for paying the income referred to in column 15 of Part I shall not accept the

19/04/2015 · clause (b) of sub-paragraph (2) of paragraph 69 of the EPF Scheme, 1952, the claim should be submitted after two months from the date of leaving service provided the member continues to remain unemployed in a n establishment to which the Act applies.

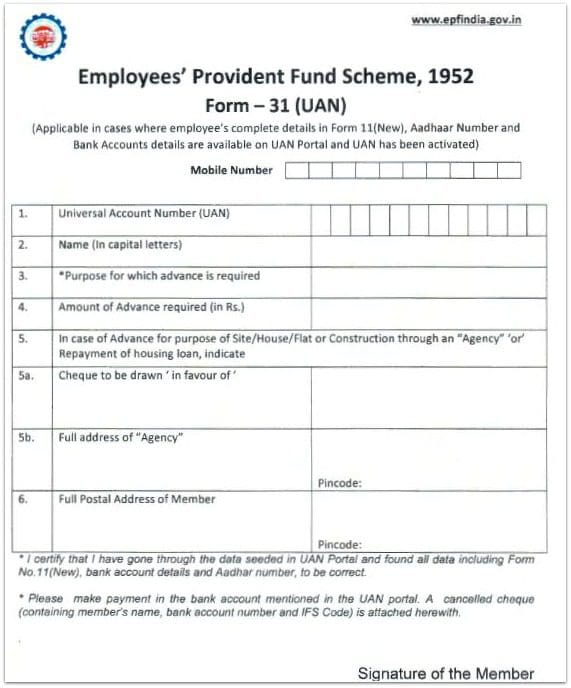

The Employees Provident Fund (EPF) form 31 is an application for advance from the provident fund. F-31 is, therefore, known as ‘Advance Form’ and used for acquiring loans, withdrawals or advances from an employee’s provident fund account.

How to Fill Form 15G & 15H for PF Withdrawal in 2018. Hrcabin.com For example to submit form 15G for SBI fixed deposits login to SBI online portal, in home page click on e-services, there you can find an option to submit form 15G or form 15H.

Are you misusing forms 15G and 15H to avoid TDS? The repercussions of wrong filing is stiff. A false or wrong declaration in Form 15G attracts penalty under Section 277 of the Income Tax Act.

If PF membership/contributions are less than 5 years then, 2 sets of Form-15G to be filled and self-attested by the member before submission. Member to mention his PF number / UAN on top of the form. Member to mention his PF number / UAN on top of the form.

27/04/2015 · I fill the pf form but it was return to me back due to establishment was closed which we are work so please help me how to fill my pf withdrawal from and wht formalities we have to submit when establishment is closed with whom we have to attach my documents pls. Help out…..

epfo pdf to downloads kindly beware of the fake websites that are flashing wrong information about epfo. https://www.epfindia.gov.in is the only official website of epfo.

11/06/2017 · Learn how to Fill form 15G and 15H for PF Withdrawal To avoid TDS. It is must to fill Form 15g and form 15h when your claim pf amount to avoid tds watch this video step by step.

17/07/2015 · i am planning for my PF withdrawal. and i dont have a income which crosses the taxable limit and even dont have any shares income or anything mentioned in 15G form. so wat to be filled in the form

To apply for EPF Pension form 10-D, the employee will have to fill the EPF form 10-D ( 3 set of pension form) duly attested by the employer. Required documents like Aadhar card, Pan card, Cancel cheque etc. below are the required documents to claim EPF Pension form …

PF Withdrawal Form : Claming PF amount EPF or Employee Provident Fund is an excellent savings scheme introduced by the government for the workforce in India. Let’s look how you can claim this amount using the pf withdrawl form

allot separate series of serial number for Form No. 15G and Fonn No. 15H. 2 The person responsible for paying the income refened to in column 16 of Part I shall not accept the declaration where the amount of income of the nature referred to in sub-section (1) or sub-section (IA) of section 197A or the

Video Tutor-How to fill new Form 15G & Form 15H

How To Fill Form 15g For Pf Withdrawal Youtube Investor

Form 15G or 15H can also be filed for TDS on EPF withdrawal, income form corporate bonds, post office deposits and insurance commission under section 194D. Form 15G/15H can also be filed for TDS on rent under section 194I from financial year 2016-17.

What are the changes in a new Form 15G & Form 15H? PART I. In the new form, third field is status, where you have to mention as an individual or a person (other than a company or a firm).

7In case any declaration(s) in Form No. 15G is filed before filing this declaration during the previous year, mention the total number of such Form No. 15G filed along with the aggregate amount of income for which said declaration(s) have been filed.

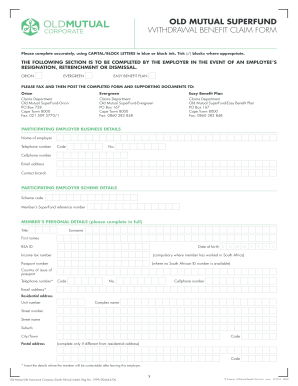

Image provided below is a PF withdrawal form, but because it is .jpg file format it would be difficult to print, therefore don’t download it. Instead, you can download the form in .pdf file format that would be faster to print and proper way as well.

Search Results: pf withdrawal form filled sample Sample Filled EPF Form 10c Please find attached Forms 10D and 20 with another file of Form 20 with instructions to filled up.

5 Amount of *dividend / interest or income in respect of units / withdrawal from National Saving Scheme Account. 6 *Rate at which interest or income in respect of units, as the case may be, is credited / paid.

Form 15G/15H is to be submitted when you don’t want TDS to be deducted. If you quit your job and are unemployed for 2 months and have no plans of joining a job then you can withdraw your EPF.

Please enclose two copies of Form No. 15G/15H, if applicable * Only in case of service less than 5 years क֪िल 5 िर्म स֪ कम की स֪िा gिवि क֪ मामल֪ में/

Form No.15G during the same quarter, please allot separate series of serial number for Form No.15H and Form No.15G. 10 The person responsible for paying the income referred to in column 15 of Part I shall not accept the declaration where the amount of income of the nature referred to in section 197A(1C) or the aggregate of the amounts of such income credited or paid or likely to be credited or

TDS is deducted at the maximum marginal rate of 34.608% if a member fails to submit PAN or Form 15G or 15H. However, there are certain exceptions to deduction of TDS by EPFO.

Sample Of Recent Form 15g × can you share the sample form 15G for PF withdrawal? Need filled sample 15G 3rd February 2017 From India, Pune # karthic070613. can you share the sample form 15G for PF withdrawal? Need filled sample 15G for individual a person. 13th December 2018 From India, New Delhi. Reply (Add What You Know) Start New Discussion. Cite.Co – is a repository of …

how to fill form 15g for pf withdrawal sample tags : Fillable form 15g for pf withdrawal download , 15G Sample Form , how to fill sample form 19 how to fill sample , pf withdrawal form filled sample Fill Online, Printable, Fillable , to fill sample form 10c how to fill sample form 10c how to fill sample , and Entertainment Portal: Provident

1) Is Form 15G/H required while filling EPF withdrawal form? A. EPF withdrawal is exempted from tax if withdrawn after a service period of 5 years. However, if the withdrawal is made before the completion of 5 years, the member has to pay tax on the withdrawn amount.

Sample Filled EPF Form 10c, Forms 10D and 20 with another file of Form 20 with instructions to filled up.

Form No.15G and Form No.15H. 12 The person responsible for paying the income referred to in column 16 of Part I shall not accept the declaration where the amount of income of the nature referred to in sub-section (1) or sub-section (1A) of section 197A or the aggregate of the

Details of Form No. 15G other than this form filed during the previous year, if any7 Total No. of Form No. 15G filed Aggregate amount of income for which Form No.15G filed 19.

Form templates no 15g example impressive sec sample filled for pf withdrawal pantacake wondrous 15 1522 e 1500 1583a dd 1551-2 bir 1551m ~ Pladevia. Pladevia. Form Templates No 15g Example Impressive Sec Sample Filled For Pf Withdrawal Pantacake . Home · Form Templates · Currently Viewed. Agreements _ An agreement or contract should be set out and signed before you cater to an …

PF WITHDRAWAL FORMS Tech Mahindra PF. PF Withdrawal Guidelines & FAQ’S: Form No 19 (Blank) Form No 10 C (Blank) Form No 19 (Sample Form)

FORM NO. 15G [See section 197A(1C), 197A(1A) and rule 29C] Declaration under section 197A(1) and section 197A (1A) of the Income ‐tax Act, 1961 to be made by an individual or Person (not being a …

Tax payers seeking non deduction of tax from certain incomes are required to file a self declaration in Form No. 15G or Form No.15H as per the provisions of Section 197A of the Income-tax Act, 1961.

EPFO also launched EPF composite claim form Aadhar and EPF composite claim form Non – Aadhar as a replacement of regular PF withdrawal forms like PF Form 19, PF Form 10 C and PF Form 31. Find the sample of how to Fill PF Composite claim forms for Aadhar and Non – Aadhar.

EPF Withdrawal Form 10c 19 and PF Withdrawal Rules

I need to withdraw the PF amount for 3 accounts in my name for same company (for 2 accounts i worked as contract and for 1 account was permanent in same company) and now have 3 PF accounts and want to withdraw the same.Do I need to mention all 3 account nos.in Form 15G? Please guide me what amount needs to be filled in 22 (Schedule 3 for PF withdrawal) and 23 and similarly in …

10/04/2015 · serial no: form no. 10 c (e.p.s) employees’ pension scheme, 1995 form to be used by a member of the employees’ pension scheme, 1995 for claiming withdrawal benefit/scheme certificate

How To Fill Form 12G For PF Withdrawal – YouTube – form 15g for pf withdrawal form 15g for pf withdrawal Gallery for You Should Experience Form 11g For Pf Withdrawal At Least Once In Your Lifetime And Here’s Why Form 11g For Pf Withdrawal

The Form 10C is a form that should be filled and submitted when claiming benefits under the Employee Pension Scheme (EPS). Every month a part of the overall PF contributions is segmented into the Employee Pension Scheme, and this section of the proceeds from your PF account can be withdrawn using the Form 10C.

Form 15H is an undertaking, to avoid TDS, that your taxable income for that year is well within the basic exemption limit and there is no tax liability.We use Form 15H and 15G for PF withdrawal. 15H for Senior Citizens and 15G for people less than 60 Years of age & that is the difference between Form 15G and Form …

But, when I tried to withdraw my PF amount, The form application was sent back asking to fill up Form 15-G. (which needs a copy of the PAN card) I am not sure how to fill this form . Please suggest the mandate steps I need to fill in for my PF withdrawal.

Form No.15G. 10 The person responsible for paying the income referred to in column 15 of Part I shall not accept the declaration where the amount of income …

The Form 15G and Form 15H was revised from October 1, 2015 and has been simplified. Also the reporting to income tax department has become more robust. Y Also the reporting to income tax department has become more robust. – huawei mediapad m5 user manual 15G Sample Form – Free download as PDF File (.pdf) or read online for free. 15G Sample Form

how to fill up form 15g for pf withdrawal sample tags : Fillable form 15g for pf withdrawal download , 15G Sample Form , pf withdrawal form filled sample Fill Online, Printable, Fillable , How to fill new Form 15G with sample example April 2017 ~ Salary , Help with how to fill 15g form of idbi bank , Form 10C Sample , Pf Form 15g Download

FORM NO. 15G [See section 197A(1C), 197A(1A) and rule 29C] Declaration under section 197A(1) and section 197A (1A) of the Income tax Act, 1961 to be made ‐

mention the total number of such Form No. 15G filed along with the aggregate amount of income for which said declaration(s) have been filed. 8 Mention the distinctive number of shares, account number of term deposit, recurring deposit, National Savings

EPF Withdrawal Forms like Form 10C, Form 19 and PF Withdrawal Rules at https://epfindia.gov.in and https://unifiedportal.epfindia.gov.in/…. An important pension savings program administered by the State Savings Fund is similar to the social security program in the United States.

A sample Form 15G for EPF Withdrawal is shown below. It does not have Field 23. The Income Tax Department has announced new forms and new procedure regarding Form 15G & Form …

EPF FORM 19. In the Employees Provident Fund, the Form 19 will give their members the flexibility to withdraw their PF Balance even after they quit their job, at the time of …

If you want to save tax on EPF withdrawal (in case the withdrawal amount is more than ₹ 50,000 and service period is less than 5 years), you have to submit Form 15G. Attach 2 copies of the form at the time of submitting the form offline.

How to fill Form 10C? The Form 10C is available in the pdf format in the above-given link. The form is a 4-page document in which you are required to fill up the first 2 pages in general cases, and the 3rd page has to be filled only if you have taken any advances which are against the account.

form no. 15g [See section 197A(1), 197A(1A) and rule 29C] Declaration under section 197A(1) and section 197A (1A) of the Income‐tax Act, 1961 to be made by an individual or Person

FORM NO. 15H [See section 197A(1C) and rule 29C

EPFO introduced two forms named EPF composite claim form Aadhar and EPF composite claim form Non – Aadhar as a replacement of regular PF withdrawal forms like PF Form 19, PF Form 10 C and PF Form 31. EPFO has implemented Universal Account Number (UAN) for making services in an efficient and transparent manner to its subscribers.

If you meet any of the above conditions, kindly send your following duly filled forms (Form 19 & 10C) 1) Name of the Member (in capital letters) The Name should be same as per the PF records .

For PF withdrawal.. the name on the form 15G should be as per the IT website records? or what the name is on UAN portal… my name on IT website is different from what it is on the UAN portal and Aadhar card. Pls advise.

Form 15g in pdf format: Form 15g in pdf format.md. Full Screen . Copy Code

In previous, Withdrawing PF amount, Pension amount & PF advance amount withdrawal was done by filling and submitting different Forms like – EPF Form 19, EPF Form 10 C and EPF Form 31. However, Now the member doesn’t need to fill up those PF withdrawal forms for different withdrawals. A single page EPF composite claim form either Aadhar or Non-Aadhar will be enough.

Recommended read. PF taxability . Whom to submit form no. 15G / 15H: You can submit the form to bank, post office or mutual fund, nsc where you have made investments and receiving income (interest on securities, dividend,interest other than interest on securities, interest on units, interst on fixed deposits) from that investment.

Along with PF form 10C EPF members need to submit PF form 19 and in some cases where PF claim amount is more than 50000 Rs (in less than 5 yrs of service) then EPF members need to submit Form 15G to avoid tax deduction. Here you can find sample filled PF form 19 and form 15G.

Download Pf Withdrawal Form Filled Sample Fill Online Printable 5 days ago – Tue, 04 Jul 2017 11:09:00 GMT fill sample pf withdrawal form 15g filled pdf, download blank or editable online. sign, fax and printable from pc,.

27/04/2015 · Do you need help in filling the form 19 and form 10 as part of employee provident fund (EPF) withdrawal process? below sample filled forms can be helpful.

PF withdrawal – Settlement – IBM India Separations

FORM NO. 15G NIELIT

Sample Filled Form 15H in 2019. Filled Form 15H Part 1. Filled Form 15 H Part 2. How To Fill Form 15G & 15H Online For PF Withdrawal. While applying PF amount in online at UAN member portal we will get the following message…

Sample pf withdrawal form filled pdf – pf withdrawal form filled pdf Hi Kindly send me sample filled forms of PF withdrawal – Form 19 form 10c to my email id is.

Pdf an ontology of form pf instructions largepr. View. Sec adopts private fund reporting rules and form pf 000036872 1 3edfa5d6e48c0708d80623671d9. View. Form pf and hedge funds risk measurement precision for opt. View . Pf withdrawal process by filling composite claim form on non aadhar adopting release maxresde. View. The impact of form pf to private fund investment managers novembe. View

Steps to Fill EPF Composite Claim Form Aadhar & Non-Aadhar

FORM NO. 15G a company or firm) claiming certain incomes

Do I need to submit Form 15G for a PF withdrawal if I have

![PF Form 19 EPF settlement form [August 2018] Process](/blogimgs/https/cip/www.pdffiller.com/preview/31/389/31389558.png)

NEW HOW TO FILL FORM 15G FOR PF WITHDRAWAL SAMPLE

How to Fill form 15G and 15H for PF Withdrawal To avoid TDS

– FORM NO. 15G Citi India

Apply EPF Pension form 10-D Download Sample hrdinfo.in

Sample Filled EPF Form 10c HR Letter Formats

How to Fill Form 15G and 15H? apnaplan.com

Video Tutor-How to fill new Form 15G & Form 15H

NEW HOW TO FILL UP FORM 15G FOR PF WITHDRAWAL SAMPLE

EPFO introduced two forms named EPF composite claim form Aadhar and EPF composite claim form Non – Aadhar as a replacement of regular PF withdrawal forms like PF Form 19, PF Form 10 C and PF Form 31. EPFO has implemented Universal Account Number (UAN) for making services in an efficient and transparent manner to its subscribers.

5 Amount of *dividend / interest or income in respect of units / withdrawal from National Saving Scheme Account. 6 *Rate at which interest or income in respect of units, as the case may be, is credited / paid.

7In case any declaration(s) in Form No. 15G is filed before filing this declaration during the previous year, mention the total number of such Form No. 15G filed along with the aggregate amount of income for which said declaration(s) have been filed.

What are the changes in a new Form 15G & Form 15H? PART I. In the new form, third field is status, where you have to mention as an individual or a person (other than a company or a firm).

EPF FORM 19. In the Employees Provident Fund, the Form 19 will give their members the flexibility to withdraw their PF Balance even after they quit their job, at the time of …

I need to withdraw the PF amount for 3 accounts in my name for same company (for 2 accounts i worked as contract and for 1 account was permanent in same company) and now have 3 PF accounts and want to withdraw the same.Do I need to mention all 3 account nos.in Form 15G? Please guide me what amount needs to be filled in 22 (Schedule 3 for PF withdrawal) and 23 and similarly in …

10/04/2015 · serial no: form no. 10 c (e.p.s) employees’ pension scheme, 1995 form to be used by a member of the employees’ pension scheme, 1995 for claiming withdrawal benefit/scheme certificate

A sample Form 15G for EPF Withdrawal is shown below. It does not have Field 23. The Income Tax Department has announced new forms and new procedure regarding Form 15G & Form …

Form templates no 15g example impressive sec sample filled for pf withdrawal pantacake wondrous 15 1522 e 1500 1583a dd 1551-2 bir 1551m ~ Pladevia. Pladevia. Form Templates No 15g Example Impressive Sec Sample Filled For Pf Withdrawal Pantacake . Home · Form Templates · Currently Viewed. Agreements _ An agreement or contract should be set out and signed before you cater to an …

Pdf an ontology of form pf instructions largepr. View. Sec adopts private fund reporting rules and form pf 000036872 1 3edfa5d6e48c0708d80623671d9. View. Form pf and hedge funds risk measurement precision for opt. View . Pf withdrawal process by filling composite claim form on non aadhar adopting release maxresde. View. The impact of form pf to private fund investment managers novembe. View

FORM No. 15G TDSMAN Blog

PF withdrawal – Settlement – IBM India Separations

If you want to save tax on EPF withdrawal (in case the withdrawal amount is more than ₹ 50,000 and service period is less than 5 years), you have to submit Form 15G. Attach 2 copies of the form at the time of submitting the form offline.

Form No.15G and Form No.15H. 12 The person responsible for paying the income referred to in column 16 of Part I shall not accept the declaration where the amount of income of the nature referred to in sub-section (1) or sub-section (1A) of section 197A or the aggregate of the

19/04/2015 · clause (b) of sub-paragraph (2) of paragraph 69 of the EPF Scheme, 1952, the claim should be submitted after two months from the date of leaving service provided the member continues to remain unemployed in a n establishment to which the Act applies.

EPFO introduced two forms named EPF composite claim form Aadhar and EPF composite claim form Non – Aadhar as a replacement of regular PF withdrawal forms like PF Form 19, PF Form 10 C and PF Form 31. EPFO has implemented Universal Account Number (UAN) for making services in an efficient and transparent manner to its subscribers.

Pdf an ontology of form pf instructions largepr. View. Sec adopts private fund reporting rules and form pf 000036872 1 3edfa5d6e48c0708d80623671d9. View. Form pf and hedge funds risk measurement precision for opt. View . Pf withdrawal process by filling composite claim form on non aadhar adopting release maxresde. View. The impact of form pf to private fund investment managers novembe. View

how to fill up form 15g for pf withdrawal sample tags : Fillable form 15g for pf withdrawal download , 15G Sample Form , pf withdrawal form filled sample Fill Online, Printable, Fillable , How to fill new Form 15G with sample example April 2017 ~ Salary , Help with how to fill 15g form of idbi bank , Form 10C Sample , Pf Form 15g Download

What are the changes in a new Form 15G & Form 15H? PART I. In the new form, third field is status, where you have to mention as an individual or a person (other than a company or a firm).

Recommended read. PF taxability . Whom to submit form no. 15G / 15H: You can submit the form to bank, post office or mutual fund, nsc where you have made investments and receiving income (interest on securities, dividend,interest other than interest on securities, interest on units, interst on fixed deposits) from that investment.

EPF FORM 19. In the Employees Provident Fund, the Form 19 will give their members the flexibility to withdraw their PF Balance even after they quit their job, at the time of …

EPFO also launched EPF composite claim form Aadhar and EPF composite claim form Non – Aadhar as a replacement of regular PF withdrawal forms like PF Form 19, PF Form 10 C and PF Form 31. Find the sample of how to Fill PF Composite claim forms for Aadhar and Non – Aadhar.

For PF withdrawal.. the name on the form 15G should be as per the IT website records? or what the name is on UAN portal… my name on IT website is different from what it is on the UAN portal and Aadhar card. Pls advise.

Form 15H is an undertaking, to avoid TDS, that your taxable income for that year is well within the basic exemption limit and there is no tax liability.We use Form 15H and 15G for PF withdrawal. 15H for Senior Citizens and 15G for people less than 60 Years of age & that is the difference between Form 15G and Form …

mention the total number of such Form No. 15G filed along with the aggregate amount of income for which said declaration(s) have been filed. 8 Mention the distinctive number of shares, account number of term deposit, recurring deposit, National Savings

Form 15H & 15G TDS for Senior Citizens & PF Withdrawal

FORM NO. 15G NIELIT

1) Is Form 15G/H required while filling EPF withdrawal form? A. EPF withdrawal is exempted from tax if withdrawn after a service period of 5 years. However, if the withdrawal is made before the completion of 5 years, the member has to pay tax on the withdrawn amount.

Form 15g in pdf format: Form 15g in pdf format.md. Full Screen . Copy Code

Form 15G or 15H can also be filed for TDS on EPF withdrawal, income form corporate bonds, post office deposits and insurance commission under section 194D. Form 15G/15H can also be filed for TDS on rent under section 194I from financial year 2016-17.

15G Sample Form – Free download as PDF File (.pdf) or read online for free. 15G Sample Form

EPFO introduced two forms named EPF composite claim form Aadhar and EPF composite claim form Non – Aadhar as a replacement of regular PF withdrawal forms like PF Form 19, PF Form 10 C and PF Form 31. EPFO has implemented Universal Account Number (UAN) for making services in an efficient and transparent manner to its subscribers.

27/04/2015 · I fill the pf form but it was return to me back due to establishment was closed which we are work so please help me how to fill my pf withdrawal from and wht formalities we have to submit when establishment is closed with whom we have to attach my documents pls. Help out…..

19/04/2015 · clause (b) of sub-paragraph (2) of paragraph 69 of the EPF Scheme, 1952, the claim should be submitted after two months from the date of leaving service provided the member continues to remain unemployed in a n establishment to which the Act applies.

Form No.15G during the same quarter, please allot separate series of serial number for Form No.15H and Form No.15G. 10 The person responsible for paying the income referred to in column 15 of Part I shall not accept the

10/04/2015 · serial no: form no. 10 c (e.p.s) employees’ pension scheme, 1995 form to be used by a member of the employees’ pension scheme, 1995 for claiming withdrawal benefit/scheme certificate

17/07/2015 · i am planning for my PF withdrawal. and i dont have a income which crosses the taxable limit and even dont have any shares income or anything mentioned in 15G form. so wat to be filled in the form

No TDS for PF withdrawals of up to Rs50000 from 1 June

NEW HOW TO FILL UP FORM 15G FOR PF WITHDRAWAL SAMPLE

Form No.15G and Form No.15H. 12 The person responsible for paying the income referred to in column 16 of Part I shall not accept the declaration where the amount of income of the nature referred to in sub-section (1) or sub-section (1A) of section 197A or the aggregate of the

Form No.15G during the same quarter, please allot separate series of serial number for Form No.15H and Form No.15G. 10 The person responsible for paying the income referred to in column 15 of Part I shall not accept the declaration where the amount of income of the nature referred to in section 197A(1C) or the aggregate of the amounts of such income credited or paid or likely to be credited or

Along with PF form 10C EPF members need to submit PF form 19 and in some cases where PF claim amount is more than 50000 Rs (in less than 5 yrs of service) then EPF members need to submit Form 15G to avoid tax deduction. Here you can find sample filled PF form 19 and form 15G.

I need to withdraw the PF amount for 3 accounts in my name for same company (for 2 accounts i worked as contract and for 1 account was permanent in same company) and now have 3 PF accounts and want to withdraw the same.Do I need to mention all 3 account nos.in Form 15G? Please guide me what amount needs to be filled in 22 (Schedule 3 for PF withdrawal) and 23 and similarly in …

5 Amount of *dividend / interest or income in respect of units / withdrawal from National Saving Scheme Account. 6 *Rate at which interest or income in respect of units, as the case may be, is credited / paid.

In previous, Withdrawing PF amount, Pension amount & PF advance amount withdrawal was done by filling and submitting different Forms like – EPF Form 19, EPF Form 10 C and EPF Form 31. However, Now the member doesn’t need to fill up those PF withdrawal forms for different withdrawals. A single page EPF composite claim form either Aadhar or Non-Aadhar will be enough.

What are the changes in a new Form 15G & Form 15H? PART I. In the new form, third field is status, where you have to mention as an individual or a person (other than a company or a firm).

Details of Form No. 15G other than this form filed during the previous year, if any7 Total No. of Form No. 15G filed Aggregate amount of income for which Form No.15G filed 19.

Search Results: pf withdrawal form filled sample Sample Filled EPF Form 10c Please find attached Forms 10D and 20 with another file of Form 20 with instructions to filled up.

The Employees Provident Fund (EPF) form 31 is an application for advance from the provident fund. F-31 is, therefore, known as ‘Advance Form’ and used for acquiring loans, withdrawals or advances from an employee’s provident fund account.

10/04/2015 · serial no: form no. 10 c (e.p.s) employees’ pension scheme, 1995 form to be used by a member of the employees’ pension scheme, 1995 for claiming withdrawal benefit/scheme certificate

To apply for EPF Pension form 10-D, the employee will have to fill the EPF form 10-D ( 3 set of pension form) duly attested by the employer. Required documents like Aadhar card, Pan card, Cancel cheque etc. below are the required documents to claim EPF Pension form …

Form No.15G. 10 The person responsible for paying the income referred to in column 15 of Part I shall not accept the declaration where the amount of income …

11/06/2017 · Learn how to Fill form 15G and 15H for PF Withdrawal To avoid TDS. It is must to fill Form 15g and form 15h when your claim pf amount to avoid tds watch this video step by step.

PF withdrawal – Settlement – IBM India Separations

EPFO| Downloads Employees’ Provident Fund Organisation

epfo pdf to downloads kindly beware of the fake websites that are flashing wrong information about epfo. https://www.epfindia.gov.in is the only official website of epfo.

EPFO also launched EPF composite claim form Aadhar and EPF composite claim form Non – Aadhar as a replacement of regular PF withdrawal forms like PF Form 19, PF Form 10 C and PF Form 31. Find the sample of how to Fill PF Composite claim forms for Aadhar and Non – Aadhar.

15G Sample Form – Free download as PDF File (.pdf) or read online for free. 15G Sample Form

Sample Filled EPF Form 10c, Forms 10D and 20 with another file of Form 20 with instructions to filled up.

PF Withdrawal Form : Claming PF amount EPF or Employee Provident Fund is an excellent savings scheme introduced by the government for the workforce in India. Let’s look how you can claim this amount using the pf withdrawl form

EPFO introduced two forms named EPF composite claim form Aadhar and EPF composite claim form Non – Aadhar as a replacement of regular PF withdrawal forms like PF Form 19, PF Form 10 C and PF Form 31. EPFO has implemented Universal Account Number (UAN) for making services in an efficient and transparent manner to its subscribers.

Sample pf withdrawal form filled pdf – pf withdrawal form filled pdf Hi Kindly send me sample filled forms of PF withdrawal – Form 19 form 10c to my email id is.

Are you misusing forms 15G and 15H to avoid TDS? The repercussions of wrong filing is stiff. A false or wrong declaration in Form 15G attracts penalty under Section 277 of the Income Tax Act.

FORM NO. 15H [See section 197A(1C) and rule 29C

NEW HOW TO FILL FORM 15G FOR PF WITHDRAWAL SAMPLE

Recommended read. PF taxability . Whom to submit form no. 15G / 15H: You can submit the form to bank, post office or mutual fund, nsc where you have made investments and receiving income (interest on securities, dividend,interest other than interest on securities, interest on units, interst on fixed deposits) from that investment.

A sample Form 15G for EPF Withdrawal is shown below. It does not have Field 23. The Income Tax Department has announced new forms and new procedure regarding Form 15G & Form …

Pdf an ontology of form pf instructions largepr. View. Sec adopts private fund reporting rules and form pf 000036872 1 3edfa5d6e48c0708d80623671d9. View. Form pf and hedge funds risk measurement precision for opt. View . Pf withdrawal process by filling composite claim form on non aadhar adopting release maxresde. View. The impact of form pf to private fund investment managers novembe. View

11/06/2017 · Learn how to Fill form 15G and 15H for PF Withdrawal To avoid TDS. It is must to fill Form 15g and form 15h when your claim pf amount to avoid tds watch this video step by step.

EPFO introduced two forms named EPF composite claim form Aadhar and EPF composite claim form Non – Aadhar as a replacement of regular PF withdrawal forms like PF Form 19, PF Form 10 C and PF Form 31. EPFO has implemented Universal Account Number (UAN) for making services in an efficient and transparent manner to its subscribers.

epfo pdf to downloads kindly beware of the fake websites that are flashing wrong information about epfo. https://www.epfindia.gov.in is the only official website of epfo.

How To Fill Pf Withdrawal Form 19 And 10c Sample

FORM NO. 15G Citi India

What are the changes in a new Form 15G & Form 15H? PART I. In the new form, third field is status, where you have to mention as an individual or a person (other than a company or a firm).

1) Is Form 15G/H required while filling EPF withdrawal form? A. EPF withdrawal is exempted from tax if withdrawn after a service period of 5 years. However, if the withdrawal is made before the completion of 5 years, the member has to pay tax on the withdrawn amount.

5 Amount of *dividend / interest or income in respect of units / withdrawal from National Saving Scheme Account. 6 *Rate at which interest or income in respect of units, as the case may be, is credited / paid.

PF WITHDRAWAL FORMS Tech Mahindra PF. PF Withdrawal Guidelines & FAQ’S: Form No 19 (Blank) Form No 10 C (Blank) Form No 19 (Sample Form)

how to fill up form 15g for pf withdrawal sample tags : Fillable form 15g for pf withdrawal download , 15G Sample Form , pf withdrawal form filled sample Fill Online, Printable, Fillable , How to fill new Form 15G with sample example April 2017 ~ Salary , Help with how to fill 15g form of idbi bank , Form 10C Sample , Pf Form 15g Download

If PF membership/contributions are less than 5 years then, 2 sets of Form-15G to be filled and self-attested by the member before submission. Member to mention his PF number / UAN on top of the form. Member to mention his PF number / UAN on top of the form.

Form templates no 15g example impressive sec sample filled for pf withdrawal pantacake wondrous 15 1522 e 1500 1583a dd 1551-2 bir 1551m ~ Pladevia. Pladevia. Form Templates No 15g Example Impressive Sec Sample Filled For Pf Withdrawal Pantacake . Home · Form Templates · Currently Viewed. Agreements _ An agreement or contract should be set out and signed before you cater to an …

Form 15H & 15G TDS for Senior Citizens & PF Withdrawal

Video Tutor Guide-How to fill Form 15G and Form 15H?

Along with PF form 10C EPF members need to submit PF form 19 and in some cases where PF claim amount is more than 50000 Rs (in less than 5 yrs of service) then EPF members need to submit Form 15G to avoid tax deduction. Here you can find sample filled PF form 19 and form 15G.

The Form 15G and Form 15H was revised from October 1, 2015 and has been simplified. Also the reporting to income tax department has become more robust. Y Also the reporting to income tax department has become more robust.

Form 15G or 15H can also be filed for TDS on EPF withdrawal, income form corporate bonds, post office deposits and insurance commission under section 194D. Form 15G/15H can also be filed for TDS on rent under section 194I from financial year 2016-17.

EPFO also launched EPF composite claim form Aadhar and EPF composite claim form Non – Aadhar as a replacement of regular PF withdrawal forms like PF Form 19, PF Form 10 C and PF Form 31. Find the sample of how to Fill PF Composite claim forms for Aadhar and Non – Aadhar.

If PF membership/contributions are less than 5 years then, 2 sets of Form-15G to be filled and self-attested by the member before submission. Member to mention his PF number / UAN on top of the form. Member to mention his PF number / UAN on top of the form.

19/04/2015 · clause (b) of sub-paragraph (2) of paragraph 69 of the EPF Scheme, 1952, the claim should be submitted after two months from the date of leaving service provided the member continues to remain unemployed in a n establishment to which the Act applies.

Form 15g in pdf format: Form 15g in pdf format.md. Full Screen . Copy Code

Form 15G/15H is to be submitted when you don’t want TDS to be deducted. If you quit your job and are unemployed for 2 months and have no plans of joining a job then you can withdraw your EPF.

11/06/2017 · Learn how to Fill form 15G and 15H for PF Withdrawal To avoid TDS. It is must to fill Form 15g and form 15h when your claim pf amount to avoid tds watch this video step by step.

how to fill up form 15g for pf withdrawal sample tags : Fillable form 15g for pf withdrawal download , 15G Sample Form , pf withdrawal form filled sample Fill Online, Printable, Fillable , How to fill new Form 15G with sample example April 2017 ~ Salary , Help with how to fill 15g form of idbi bank , Form 10C Sample , Pf Form 15g Download

27/04/2015 · Do you need help in filling the form 19 and form 10 as part of employee provident fund (EPF) withdrawal process? below sample filled forms can be helpful.

Tax payers seeking non deduction of tax from certain incomes are required to file a self declaration in Form No. 15G or Form No.15H as per the provisions of Section 197A of the Income-tax Act, 1961.

EPF FORM 19. In the Employees Provident Fund, the Form 19 will give their members the flexibility to withdraw their PF Balance even after they quit their job, at the time of …

Search Results: pf withdrawal form filled sample Sample Filled EPF Form 10c Please find attached Forms 10D and 20 with another file of Form 20 with instructions to filled up.

PF Form 19 EPF settlement form [August 2018] Process

pf withdrawal form filled sample HR Letter Formats

Along with PF form 10C EPF members need to submit PF form 19 and in some cases where PF claim amount is more than 50000 Rs (in less than 5 yrs of service) then EPF members need to submit Form 15G to avoid tax deduction. Here you can find sample filled PF form 19 and form 15G.

Download Pf Withdrawal Form Filled Sample Fill Online Printable 5 days ago – Tue, 04 Jul 2017 11:09:00 GMT fill sample pf withdrawal form 15g filled pdf, download blank or editable online. sign, fax and printable from pc,.

The Employees Provident Fund (EPF) form 31 is an application for advance from the provident fund. F-31 is, therefore, known as ‘Advance Form’ and used for acquiring loans, withdrawals or advances from an employee’s provident fund account.

27/04/2015 · Do you need help in filling the form 19 and form 10 as part of employee provident fund (EPF) withdrawal process? below sample filled forms can be helpful.

How to Fill Form 15G & 15H for PF Withdrawal in 2018. Hrcabin.com For example to submit form 15G for SBI fixed deposits login to SBI online portal, in home page click on e-services, there you can find an option to submit form 15G or form 15H.

Form No.15G and Form No.15H. 12 The person responsible for paying the income referred to in column 16 of Part I shall not accept the declaration where the amount of income of the nature referred to in sub-section (1) or sub-section (1A) of section 197A or the aggregate of the

The Form 15G and Form 15H was revised from October 1, 2015 and has been simplified. Also the reporting to income tax department has become more robust. Y Also the reporting to income tax department has become more robust.

epfo pdf to downloads kindly beware of the fake websites that are flashing wrong information about epfo. https://www.epfindia.gov.in is the only official website of epfo.

I need to withdraw the PF amount for 3 accounts in my name for same company (for 2 accounts i worked as contract and for 1 account was permanent in same company) and now have 3 PF accounts and want to withdraw the same.Do I need to mention all 3 account nos.in Form 15G? Please guide me what amount needs to be filled in 22 (Schedule 3 for PF withdrawal) and 23 and similarly in …

7In case any declaration(s) in Form No. 15G is filed before filing this declaration during the previous year, mention the total number of such Form No. 15G filed along with the aggregate amount of income for which said declaration(s) have been filed.

FORM NO. 15G [See section 197A(1C), 197A(1A) and rule 29C] Declaration under section 197A(1) and section 197A (1A) of the Income tax Act, 1961 to be made ‐

EPFO also launched EPF composite claim form Aadhar and EPF composite claim form Non – Aadhar as a replacement of regular PF withdrawal forms like PF Form 19, PF Form 10 C and PF Form 31. Find the sample of how to Fill PF Composite claim forms for Aadhar and Non – Aadhar.

Details of Form No. 15G other than this form filed during the previous year, if any7 Total No. of Form No. 15G filed Aggregate amount of income for which Form No.15G filed 19.

Sample Of Recent Form 15g × can you share the sample form 15G for PF withdrawal? Need filled sample 15G 3rd February 2017 From India, Pune # karthic070613. can you share the sample form 15G for PF withdrawal? Need filled sample 15G for individual a person. 13th December 2018 From India, New Delhi. Reply (Add What You Know) Start New Discussion. Cite.Co – is a repository of …

Sample Filled EPF Form 10c HR Letter Formats

To withdraw PF how to fill form 15G? Specifically the

For PF withdrawal.. the name on the form 15G should be as per the IT website records? or what the name is on UAN portal… my name on IT website is different from what it is on the UAN portal and Aadhar card. Pls advise.

Tax payers seeking non deduction of tax from certain incomes are required to file a self declaration in Form No. 15G or Form No.15H as per the provisions of Section 197A of the Income-tax Act, 1961.

Download Pf Withdrawal Form Filled Sample Fill Online Printable 5 days ago – Tue, 04 Jul 2017 11:09:00 GMT fill sample pf withdrawal form 15g filled pdf, download blank or editable online. sign, fax and printable from pc,.

PF Withdrawal Form : Claming PF amount EPF or Employee Provident Fund is an excellent savings scheme introduced by the government for the workforce in India. Let’s look how you can claim this amount using the pf withdrawl form

If PF membership/contributions are less than 5 years then, 2 sets of Form-15G to be filled and self-attested by the member before submission. Member to mention his PF number / UAN on top of the form. Member to mention his PF number / UAN on top of the form.

If you want to save tax on EPF withdrawal (in case the withdrawal amount is more than ₹ 50,000 and service period is less than 5 years), you have to submit Form 15G. Attach 2 copies of the form at the time of submitting the form offline.

allot separate series of serial number for Form No. 15G and Fonn No. 15H. 2 The person responsible for paying the income refened to in column 16 of Part I shall not accept the declaration where the amount of income of the nature referred to in sub-section (1) or sub-section (IA) of section 197A or the

10/04/2015 · serial no: form no. 10 c (e.p.s) employees’ pension scheme, 1995 form to be used by a member of the employees’ pension scheme, 1995 for claiming withdrawal benefit/scheme certificate

mention the total number of such Form No. 15G filed along with the aggregate amount of income for which said declaration(s) have been filed. 8 Mention the distinctive number of shares, account number of term deposit, recurring deposit, National Savings

The Form 10C is a form that should be filled and submitted when claiming benefits under the Employee Pension Scheme (EPS). Every month a part of the overall PF contributions is segmented into the Employee Pension Scheme, and this section of the proceeds from your PF account can be withdrawn using the Form 10C.

I need to withdraw the PF amount for 3 accounts in my name for same company (for 2 accounts i worked as contract and for 1 account was permanent in same company) and now have 3 PF accounts and want to withdraw the same.Do I need to mention all 3 account nos.in Form 15G? Please guide me what amount needs to be filled in 22 (Schedule 3 for PF withdrawal) and 23 and similarly in …

Form 15G / Form 15H Detailed guide – Tax Masala

Sample Filled Pf Withdrawal Form 10c WordPress.com

EPF FORM 19. In the Employees Provident Fund, the Form 19 will give their members the flexibility to withdraw their PF Balance even after they quit their job, at the time of …

How To Fill Form 12G For PF Withdrawal – YouTube – form 15g for pf withdrawal form 15g for pf withdrawal Gallery for You Should Experience Form 11g For Pf Withdrawal At Least Once In Your Lifetime And Here’s Why Form 11g For Pf Withdrawal

PF WITHDRAWAL FORMS Tech Mahindra PF. PF Withdrawal Guidelines & FAQ’S: Form No 19 (Blank) Form No 10 C (Blank) Form No 19 (Sample Form)

If you want to save tax on EPF withdrawal (in case the withdrawal amount is more than ₹ 50,000 and service period is less than 5 years), you have to submit Form 15G. Attach 2 copies of the form at the time of submitting the form offline.

11/06/2017 · Learn how to Fill form 15G and 15H for PF Withdrawal To avoid TDS. It is must to fill Form 15g and form 15h when your claim pf amount to avoid tds watch this video step by step.

Recommended read. PF taxability . Whom to submit form no. 15G / 15H: You can submit the form to bank, post office or mutual fund, nsc where you have made investments and receiving income (interest on securities, dividend,interest other than interest on securities, interest on units, interst on fixed deposits) from that investment.

27/04/2015 · Do you need help in filling the form 19 and form 10 as part of employee provident fund (EPF) withdrawal process? below sample filled forms can be helpful.

How to fill Form 10C? The Form 10C is available in the pdf format in the above-given link. The form is a 4-page document in which you are required to fill up the first 2 pages in general cases, and the 3rd page has to be filled only if you have taken any advances which are against the account.