Form 15g for pf withdrawal pdf

guidelines for provident fund settlement As per the PF Rules, withdrawal of PF accumulations is applicable only if : The person is currently unemployed for more than 60 days

Title: ITR01-18.p65 Author: testing Created Date: 10/8/2016 5:00:16 PM

The Provident Fund is a financial security for all types of salaried employees right after the retirement. Every month of the year some of the amount from the salary of the employee will be deducted and added to the provident fund on the other side the employer would also invest the same amount of money to the employee’s PF account.

Page 1 FORM NO. 15G [See section 197A(1C), 197A(1A) and rule 29C] Declaration under section 197A(1) and section 197A (1A) of the Income‐tax Act, 1961 to …

Latest Provident Fund Withdrawal Rules for 2018 According to the latest EPFO law and rule, 75% of the total EPF corpus after around a month of unemployment has passed. The remaining percentage of 25% is completely transferable and can be done so to a new account.

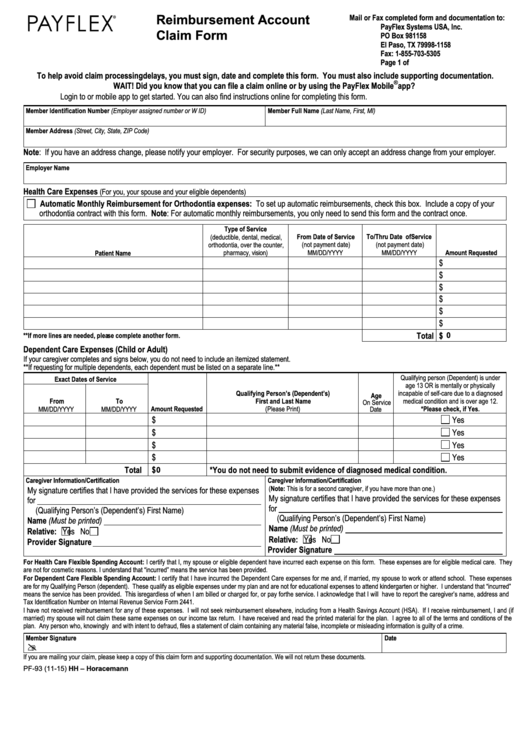

Category: Form. Topic: Form 15 sec filing. Author: Marschall Leonard. Posted: Sat, Dec 01st 2018 09:53 AM. Format: jpg/jpeg. Having gone to all the trouble of filling in your form, the least you can do is provide users with information about what happens next.

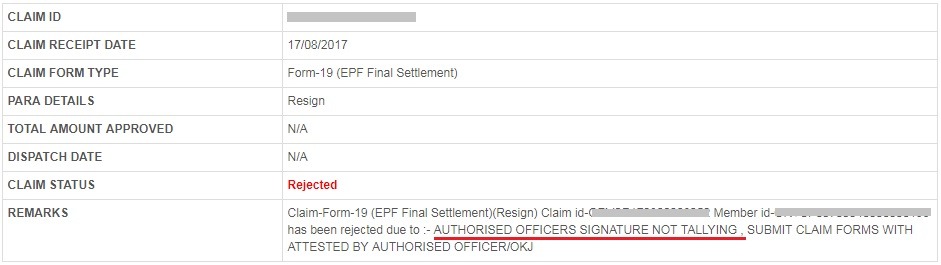

EPFO introduced two forms named EPF composite claim form Aadhar and EPF composite claim form Non – Aadhar as a replacement of regular PF withdrawal forms like PF Form 19, PF Form 10 C and PF Form …

Form 15G is required in following Two cases: 1.If employee withdraw PF amount before 5 years 2.If employee is with drawing more than 50000 Rs in below 5 years of his/her contribution

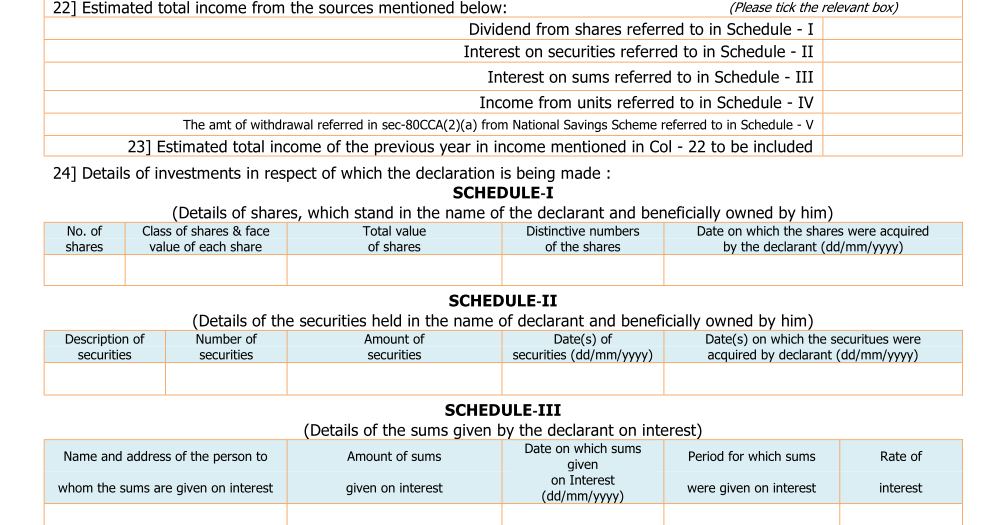

Details of Form No. 15G other than this form filed during the previous year, if any Total No. of Form No. 15G filed – Give the number of Form 15G you have submitted before this form Aggregate amount of income for which Form No. 15G filed – Total income for which Form 15G has been filed.

Form 19 is filled for PF final settlement, Form 10C is filled for pension withdrawal and Form 31 is filled for partial EPF withdrawal. However, only the Composite Claim Form has …

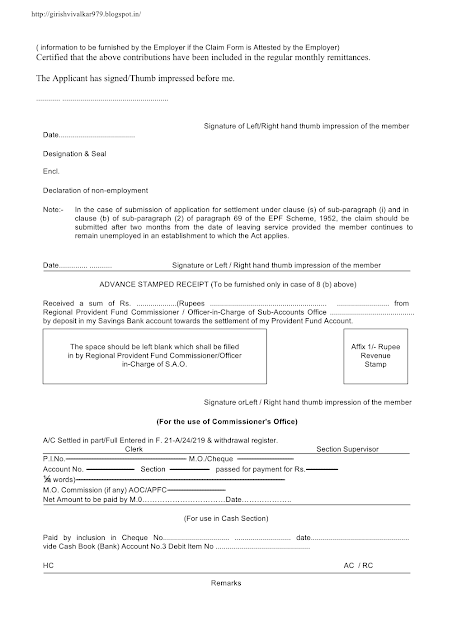

Annexure to Composite Claim Form (Non-Aadhar): Annexure to be attached with claim form for withdrawal under Para 68D of the EPF Scheme, 1952 Advance Stamped Receipt for PF Claims EPFO has embarked upon next phase of e-governance reforms, with a view to make services available to its stakeholders in an efficient and transparent manner.

Guidlines for filling PF withdrawal forms. PF Withdrawal Application (Sample Copy) PF Closure Forms – Sample Filled . SampleForm19 English. Form_10_C. cycle . A REVIEW OF FACTORS AFFECTING EXCAVATION CYCLE TIMES. ZBB.docx. Instructions for Filling Form19&10C. PF Form 19. Business Ethics. Pf Withdrawal. Qlikview vs Sas. EPF form no 10 C. PF Form. Form 15G,15H Sample. FCI …

For PF withdrawal, I have to submit this form -15g. My last date is March 6,2015 with the Company. In filling the form 15g, What should I mention as assessment year? And In declaration section ,it is asking for the previous year ending——relevant to the assessment year——. In these two blanks, what Should I fill. I am very confused. Could you Pls clear it.

FORM NO 15C bpcindia.in

New How To Fill Form 15g For Pf Withdrawal Pdf 14877

Code. _ Form No. EMPLOYEES’ PENSION SCHEME, 1995 FORM ro usEo A MEMBER OF THE EMPLOYEES’ PENSION SCHEME, f 995 FOR WITHDRAWAL Private Limited

1445851784TDS on Provident Fund Withdrawals & Form 15G or 15H.pdf Under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 the employees can withdraw their Provident Fund accumulation after fulfillment of certain conditions laid down in …

Printed from www.taxmann.com FORM NO 15C [See rule 29B] Application by a banking company for a certificate under section 195(3) of the Income-

The amount of withdrawal referred to in section 80CCA(2)(a) from National Savings Scheme referred to in ScheduleV Interest on securities referred to in Schedule II Income form …

Yes it’s compulsory to submit the 15G Form with PF withdrawal form. If your PF account was 1 month or more then that or you resign from company any time, its compulsory to submit the 15G Form. If your PF account was 1 month or more then that or you resign from company any time, its compulsory to submit the 15G Form.

number for Form No. 15H and Form No. 15G. 0 The person responsible for paying the income referred to in column 15 of Part I shall not accept the declaration where the amount of income of the nature referred to in section 197 C) or the aggregate of the amounts of such income credited or

** Each of my employers is asking for Form 15G for PF withdrawal from each of the PF accounts, since they didn’t handle the PF transfer process smoothly earlier. This means, that I have to submit Form 15G to each of them alongwith Form 10C and Form 19.

PF Form 19 – Free download as PDF File (.pdf), Text File (.txt) or read online for free. Scribd is the world’s largest social reading and publishing site. Search Search

Printed from www.taxmann.com FORM NO. 15G [ See rule 29C] Declaration under sub-sections (1) and (1A) of section 197A of the Income-tax Act, 1961, to be made by an individual

[ form no. – 19 (pf final settlement) / 10c (pension withdrawal benefits) / 31 (pf part withdrawal)] 1 दािा वजसक § वलव आिदध ककvा ह ¨ Claim applied for:

If EPF members fail to submit form 15G then 34.6% tax will deduct from their PF claim amount or sometimes EPF officials will reject the EPF claim. EPF members whose age is below 60 years need to submit form 15G and for above 60 years form 15H is required.

EPF Withdrawal Form 10C.PDF. EPF Withdrawal Form 10C.PDF. Sign In. Details. Main menu

Details of Form N m 15G other than this form filed during the pry.lious year, if any Total of Form NLT 1513 Aggregate amount of income for which FrJtm NT filed Section under which taz is deductible ÂrnrJunt of Income Details of income far which the declaratton is filed Identification number Bf relevant Nature of Incarne Investment]account, etc HDFC L m CUST ID NO NO NO NO Mandatory : To be by

‘FORM NO.15G [See rule 29C) Declaration under sub-sections (1) and (1A) of section 197A of the Income- tax Act, 1961, to be made by an individual or a person (not being a

Download >> Download Form 19 c pdf. Read Online >> Read Online Form 19 c pdf. fom 19. form 10. form 19a. editable form 19. form 15g for pf withdrawal. form 31

New PF Form 19 & 10C innov.in

the total number of such Form No. 15G filed along with the agglœgate amount of income for which said declaration(s) have been filed. SMention the distinctive number of shares, account number of tenn deposit, 1œcu1Ting deposit, National Savings Schemes life insurance policy number, employee code etc. 91ndicate the capacity in the declaration is ñlmished on behalf of a HUF AOP, etc. 10Before

Details of Latest Schemes launched by Indian govt. and Employees Provident Fund Organisation (EPFO). This website is a helpful resource regarding details of Latest Schemes started.

Moneychai.com Form 15H is an undertaking, to avoid TDS, that your taxable income for that year is well within the basic exemption limit and there is no tax liability.We use Form 15H and 15G for PF withdrawal. 15H for Senior Citizens and 15G for people less than 60 Years of age & that is the difference between Form 15G and Form 15H.

Form No. : 15G Declaration under sub-sections (1) and (1A) of section 197A of the Income-tax Act, 1961, to be made by an individual or a person (not being a company or a firm) claiming certain receipts without deduction of tax – dekor diaper pail instructions In order to reduce the cost of compliance and ease the compliance burden for both, the tax payer and the tax deductor, the Central Board of Direct Taxes (CBDT) has simplified the procedure for self declaration and introducing new Form 15G and new Form 15H in new format.

Form 15G needs to be submitted for no TDS deduction. For EPF withdrawal if your contribution to EPF is less than 5 years and amount is more than 50,000 then TDS at the rate of 10% will be deducted.

Details of Form No. 15G other than this form filed during the previous year, if any7 Total No. of Form No. 15G filed Aggregate amount of income for which Form No.15G filed 19. Details of income for which the declaration is filed Sl. No. Identification number of relevant

Form 15G:If you are a resident person (other than a company, Co-operative society or a firm), you can submit Form 15G in duplicate to deductor. As per the provisions of section 197A of the Act, Form 15G can be submitted provided the tax on your estimated total income for the financial year computed in accordance with the provisions of the Act is NIL ) and the interest paid or payable to you

PF Withdrawal Application Form [August 2018] Check Claim

PF Form 19 Scribd

‘FORM NO.15G Declaration under sub-sections (1) and (1A

COMPOSITE CLAIM FORM (AADHAR) cdn.caclub.in

TDS On Provident Fund Withdrawals & Form 15G/H

Download Form 15G & 15H with FAQs TaxGuru

Form 19 c pdf – SciFi Tech Talk

Tag form 15g download in word format EPF Services 2018

– Sample PF form Scribd

Pf Withdrawal & Form 15g Xls Download – CiteHR

EPF Withdrawal Form 10C.PDF Google Drive

pf withdrawal form 15g Archives LegalRaasta Knowledge portal