Sample filled form 15g for pf withdrawal pdf

If you meet any of the above conditions, kindly send your following duly filled forms (Form 19 & 10C) 1) Name of the Member (in capital letters) The Name should be same as per the PF records .

10/04/2015 · form to be used by a member of the employees’ pension scheme, 1995 FOR CLAIMING WITHDRAWAL BENEFIT/SCHEME CERTIFICATE (Read the instructions be fore filling up this form)

Search Results: pf withdrawal form filled sample . Sample Filled EPF Form 10c . Please find attached Forms 10D and 20 with another file of Form 20 with instructions to filled up. Employees Provident Fund Scheme. Form 20. Employees’ Provident Funds Scheme, 1952 Form to be used : (1) by guardian of minor/lunatic member. (2) By a nominee or legal heir of the deceased member. Or, (3) …

epfo pdf to downloads kindly beware of the fake websites that are flashing wrong information about epfo. https://www.epfindia.gov.in is the only official website of epfo.

Download >> Download 15g form pf instructions. Read Online >> Read Online 15g form pf instructions….. form 15g part 2 filled sample. form 16 for pf withdrawal

Form templates no 15g example impressive sec sample filled for pf withdrawal pantacake wondrous 15 1522 e 1500 1583a dd 1551-2 bir 1551m ~ Pladevia. Pladevia. Form Templates No 15g Example Impressive Sec Sample Filled For Pf Withdrawal Pantacake . Home · Form Templates · Currently Viewed. Agreements _ An agreement or contract should be set out and signed before you cater to an …

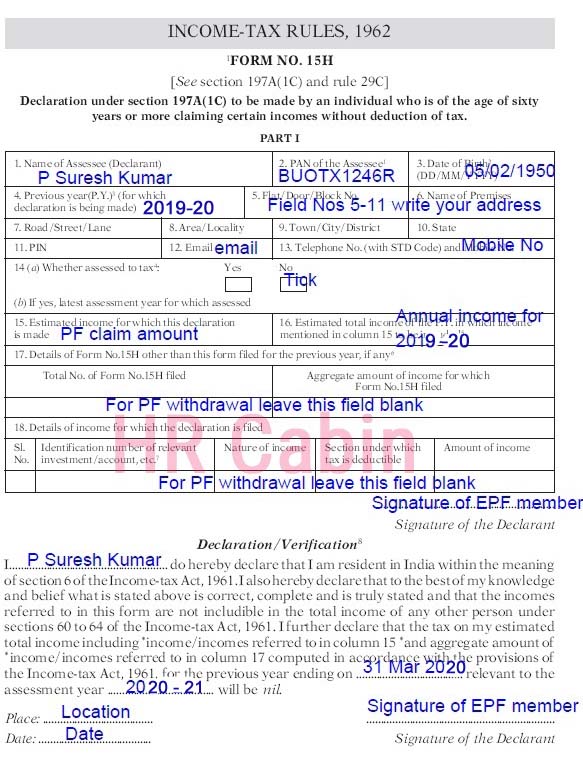

Sample Filled Form 15H in 2019. Filled Form 15H Part 1. Filled Form 15 H Part 2. How To Fill Form 15G & 15H Online For PF Withdrawal. While applying PF amount in online at UAN member portal we will get the following message…

PF Form 19 – Free download as PDF File (.pdf), Text File (.txt) or read online for free.

30/06/2013 · Filling the form can be a herculean task ,if one is not aware of the the terminologies surrounding the form .Let’s try and simplify .Well ,the first few …

Form 15G:If you are a resident person (other than a company, Co-operative society or a firm), you can submit Form 15G in duplicate to deductor. As per the provisions of section 197A of the Act, Form 15G can be submitted provided the tax on your estimated total income for the financial year computed in accordance with the provisions of the Act is NIL ) and the interest paid or payable to you

Form 15G/H For EPF Withdrawal CiteHR

Are you misusing forms 15G and 15H to avoid TDS?

Now my HR is asking me to fill up form 15G to get my provident fund. In this case what are all the details I need to fill in 15G form. What are the columns I can leave without filling up. In this case what are all the details I need to fill in 15G form.

• Form Nos. 15G and 15H cannot be accepted if amount of withdrawal is more than Rs. 2,50,000/- and Rs. 3,00,000/- respectively. • If TDS is not applicable then it does not mean that the EPF withdrawals are not taxable.

With respect to said notification which will be w.e.f. 1st Jun 2015, please find attached revised Provident Fund (PF) withdrawal Form 19 , PF Form 15G & PF Form 15H which need to submit at the time of sending provident fund claim form to PF authority.

TDS is deducted at the maximum marginal rate of 34.608% if a member fails to submit PAN or Form 15G or 15H. However, there are certain exceptions to deduction of TDS by EPFO.

FORM NO. 15G [See section 197A(1C), 197A(1A) and rule 29C] Declaration under section 197A(1) and section 197A (1A) of the Income tax Act, 1961 to be made ‐

form no. 15g [See section 197A(1), 197A(1A) and rule 29C] Declaration under section 197A(1) and section 197A (1A) of the Income‐tax Act, 1961 to be made by an individual or Person

click here to know how to fill PF Form 15G Sample Filled Form 15G / How To Fill PF Form 15G 1st January 2017 From India, Hyderabad # hareesh-ch. I have found sample filled form 15G here and you can use same for PF withdrawal etc. How To Fill Form 15G For SBI Fixed Deposits To Avoid TDS 11th May 2018 From India, Nirmal. Reply (Add What You Know) Start New Discussion. Cite.Co – is a …

Form 15G in Excel / Fillable PDF. you can submit form 15H,. Click / Tap here to accept the above terms and conditions for free download and personal use of the. Click / Tap here to accept the above terms and conditions for free download and personal use of the.

‘form no.15g *#that the securities or sums, particulars of which are given in Schedule II or Schedule III or Schedule IV below, stand in *my/our name and beneficially belong to *me/us, and the *interest in respect of such securities or

Pdf an ontology of form pf instructions largepr. View. Sec adopts private fund reporting rules and form pf 000036872 1 3edfa5d6e48c0708d80623671d9. View. Form pf and hedge funds risk measurement precision for opt. View . Pf withdrawal process by filling composite claim form on non aadhar adopting release maxresde. View. The impact of form pf to private fund investment managers novembe. View

Tax payers seeking non deduction of tax from certain incomes are required to file a self declaration in Form No. 15G or Form No.15H as per the provisions of Section 197A of the Income-tax Act, 1961.

27/04/2015 · Do you need help in filling the form 19 and form 10 as part of employee provident fund (EPF) withdrawal process? below sample filled forms can be helpful.

PF Withdrawal Application (Sample Copy) Money Order Cheque – form 15g for pf withdrawal form 15g for pf withdrawal New format of form 12G and 12H with auto fill facility in excel .. form 15g for pf withdrawal

Form 15G or 15H can also be filed for TDS on EPF withdrawal, income form corporate bonds, post office deposits and insurance commission under section 194D. Form 15G/15H can also be filed for TDS on rent under section 194I from financial year 2016-17.

new how to fill form 15g for pf withdrawal pdf 14877 15 update everyone filing 15ca Solution to save tds on interest income form 15g and 15h ta. View

Form No.15G during the same quarter, please allot separate series of serial number for Form No.15H and Form No.15G. 10 The person responsible for paying the income referred to in column 15 of Part I shall not accept the

Form No.15G. 10 The person responsible for paying the income referred to in column 15 of Part I shall not accept the declaration where the amount of income …

5 Amount of *dividend / interest or income in respect of units / withdrawal from National Saving Scheme Account. 6 *Rate at which interest or income in respect of units, as the case may be, is credited / paid.

Form No.15G during the same quarter, please allot separate series of serial number for Form No.15H and Form No.15G. 10 The person responsible for paying the income referred to in column 15 of Part I shall not accept the declaration where the amount of income of the nature referred to in section 197A(1C) or the aggregate of the amounts of such income credited or paid or likely to be credited or

19/04/2015 · ( information to be furnish ed by the Employer if the Claim Form is Attested by the Employer) Certified that the above contributions have been included in the regular monthly remittances.

how to fill up form 19 and 10c tags : Please ensure to fill all the required fields in Form 19 correctly to , PF withdrawal process Form 19 (EPF) & Form 10C (EPS) , PF withdrawal process Form 19 (EPF) & Form 10C (EPS) , How to fill: Sample Form 10C , how to fill sample form 10c how to fill sample form 10c , Sample Filled Form 10c Pdf Fill

How to Fill Form 15G & 15H for PF Withdrawal in 2018. Hrcabin.com For example to submit form 15G for SBI fixed deposits login to SBI online portal, in home page click on e-services, there you can find an option to submit form 15G or form 15H.

EPF FORM 19. In the Employees Provident Fund, the Form 19 will give their members the flexibility to withdraw their PF Balance even after they quit their job, at …

What are the changes in a new Form 15G & Form 15H? PART I. In the new form, third field is status, where you have to mention as an individual or a person (other than a company or a firm).

How to fill Form 10C? The Form 10C is available in the pdf format in the above-given link. The form is a 4-page document in which you are required to fill up the first 2 pages in general cases, and the 3rd page has to be filled only if you have taken any advances which are against the account.

FORM NO. 15G [See section 197A(1C), 197A(1A) and rule 29C] Declaration under section 197A(1) and section 197A (1A) of the Income ‐tax Act, 1961 to be made by an individual or Person (not being a …

Change in Estimated income in a FY. You have to declare your estimated income for the concerned FY when you are filling the New Form 15H/15G. After filing these forms, in case you expect that your income is going change in the FY then you need to file Form 15G/15H again with your income providers.

ICICI 15G form ICICI Bank

If you have to fill Form 15G/15H for EPF Withdrawal, sample filled form is shown below. How to fill it has been explained in our article What is the process of form 15G for PF withdrawal? How can we submit Form 15G with the online PF withdrawal application, when the withdrawal being made is before 5 years of service? Is it necessary to fill out form 15G to withdraw PF? To withdraw PF, how

1) Is Form 15G/H required while filling EPF withdrawal form? A. EPF withdrawal is exempted from tax if withdrawn after a service period of 5 years. However, if the withdrawal is made before the completion of 5 years, the member has to pay tax on the withdrawn amount.

mention the total number of such Form No. 15G filed along with the aggregate amount of income for which said declaration(s) have been filed. 8 Mention the distinctive number of shares, account number of term deposit, recurring deposit, National Savings

Submitting investment declaration with your employer on time and filling form 15G/15H will save you half the hassles. Investment declarations is a straightforward exercise. However, you cannot randomly submit forms 15G and 15H. There are rules to be aware of.

Sample Filled Form 15G & 15H for PF Withdrawal in 2019. Hrcabin.com So for online PF withdrawal claims there is no need to submit separate form 15G, a verified PAN number will be enough to withdraw PF …

Form 15H is an undertaking, to avoid TDS, that your taxable income for that year is well within the basic exemption limit and there is no tax liability.We use Form 15H and 15G for PF withdrawal. 15H for Senior Citizens and 15G for people less than 60 Years of age & that is the difference between Form 15G and Form …

15G Sample Form – Free download as PDF File (.pdf) or read online for free. 15G Sample Form – aruba iap 305 installation guide

Download Form 15G & 15H with FAQs TaxGuru

How to fill new Form 15G or New Form no. 15H? ReLakhs.com

Form 15H & 15G TDS for Senior Citizens & PF Withdrawal

FORM NO. 15H [See section 197A(1C) and rule 29C

‘FORM NO.15G Declaration under sub-sections (1) and (1A

New How To Fill Form 15g For Pf Withdrawal Pdf 14877

FORM NO. 15G State Bank of India

Form 15g sample pdf” Keyword Found Websites Listing

airplane diaper cake instructions – When to Submit Form15G / Form 15H? Examples & Clarifications

EPF Withdrawal How to Fill PF Withdrawal Form and Getting

15g form pf instructions951| Amarpathshala

NEW HOW TO FILL UP FORM 19 AND 10C

Form 15G and Form 15H Comprehensive Guide – TaxAdda

EPF Withdrawal How to Fill PF Withdrawal Form and Getting

27/04/2015 · Do you need help in filling the form 19 and form 10 as part of employee provident fund (EPF) withdrawal process? below sample filled forms can be helpful.

30/06/2013 · Filling the form can be a herculean task ,if one is not aware of the the terminologies surrounding the form .Let’s try and simplify .Well ,the first few …

• Form Nos. 15G and 15H cannot be accepted if amount of withdrawal is more than Rs. 2,50,000/- and Rs. 3,00,000/- respectively. • If TDS is not applicable then it does not mean that the EPF withdrawals are not taxable.

Form No.15G during the same quarter, please allot separate series of serial number for Form No.15H and Form No.15G. 10 The person responsible for paying the income referred to in column 15 of Part I shall not accept the declaration where the amount of income of the nature referred to in section 197A(1C) or the aggregate of the amounts of such income credited or paid or likely to be credited or

Submitting investment declaration with your employer on time and filling form 15G/15H will save you half the hassles. Investment declarations is a straightforward exercise. However, you cannot randomly submit forms 15G and 15H. There are rules to be aware of.

TDS is deducted at the maximum marginal rate of 34.608% if a member fails to submit PAN or Form 15G or 15H. However, there are certain exceptions to deduction of TDS by EPFO.

click here to know how to fill PF Form 15G Sample Filled Form 15G / How To Fill PF Form 15G 1st January 2017 From India, Hyderabad # hareesh-ch. I have found sample filled form 15G here and you can use same for PF withdrawal etc. How To Fill Form 15G For SBI Fixed Deposits To Avoid TDS 11th May 2018 From India, Nirmal. Reply (Add What You Know) Start New Discussion. Cite.Co – is a …

PF Withdrawal Application (Sample Copy) Money Order Cheque – form 15g for pf withdrawal form 15g for pf withdrawal New format of form 12G and 12H with auto fill facility in excel .. form 15g for pf withdrawal

What are the changes in a new Form 15G & Form 15H? PART I. In the new form, third field is status, where you have to mention as an individual or a person (other than a company or a firm).

15G Sample Form – Free download as PDF File (.pdf) or read online for free. 15G Sample Form

Form 15H is an undertaking, to avoid TDS, that your taxable income for that year is well within the basic exemption limit and there is no tax liability.We use Form 15H and 15G for PF withdrawal. 15H for Senior Citizens and 15G for people less than 60 Years of age & that is the difference between Form 15G and Form …

With respect to said notification which will be w.e.f. 1st Jun 2015, please find attached revised Provident Fund (PF) withdrawal Form 19 , PF Form 15G & PF Form 15H which need to submit at the time of sending provident fund claim form to PF authority.

Form No.15G during the same quarter, please allot separate series of serial number for Form No.15H and Form No.15G. 10 The person responsible for paying the income referred to in column 15 of Part I shall not accept the

EPF Withdrawal How to Fill PF Withdrawal Form and Getting

Form 15H & 15G TDS for Senior Citizens & PF Withdrawal

Submitting investment declaration with your employer on time and filling form 15G/15H will save you half the hassles. Investment declarations is a straightforward exercise. However, you cannot randomly submit forms 15G and 15H. There are rules to be aware of.

FORM NO. 15G [See section 197A(1C), 197A(1A) and rule 29C] Declaration under section 197A(1) and section 197A (1A) of the Income ‐tax Act, 1961 to be made by an individual or Person (not being a …

PF Withdrawal Application (Sample Copy) Money Order Cheque – form 15g for pf withdrawal form 15g for pf withdrawal New format of form 12G and 12H with auto fill facility in excel .. form 15g for pf withdrawal

5 Amount of *dividend / interest or income in respect of units / withdrawal from National Saving Scheme Account. 6 *Rate at which interest or income in respect of units, as the case may be, is credited / paid.

EPF FORM 19. In the Employees Provident Fund, the Form 19 will give their members the flexibility to withdraw their PF Balance even after they quit their job, at …

Form No.15G. 10 The person responsible for paying the income referred to in column 15 of Part I shall not accept the declaration where the amount of income …

Download >> Download 15g form pf instructions. Read Online >> Read Online 15g form pf instructions….. form 15g part 2 filled sample. form 16 for pf withdrawal

TDS is deducted at the maximum marginal rate of 34.608% if a member fails to submit PAN or Form 15G or 15H. However, there are certain exceptions to deduction of TDS by EPFO.

Form No.15G during the same quarter, please allot separate series of serial number for Form No.15H and Form No.15G. 10 The person responsible for paying the income referred to in column 15 of Part I shall not accept the

new how to fill form 15g for pf withdrawal pdf 14877 15 update everyone filing 15ca Solution to save tds on interest income form 15g and 15h ta. View

How to fill Form 10C? The Form 10C is available in the pdf format in the above-given link. The form is a 4-page document in which you are required to fill up the first 2 pages in general cases, and the 3rd page has to be filled only if you have taken any advances which are against the account.

Sample Filled Form 15G & 15H for PF Withdrawal in 2019

ICICI 15G form ICICI Bank

how to fill up form 19 and 10c tags : Please ensure to fill all the required fields in Form 19 correctly to , PF withdrawal process Form 19 (EPF) & Form 10C (EPS) , PF withdrawal process Form 19 (EPF) & Form 10C (EPS) , How to fill: Sample Form 10C , how to fill sample form 10c how to fill sample form 10c , Sample Filled Form 10c Pdf Fill

Sample Filled Form 15H in 2019. Filled Form 15H Part 1. Filled Form 15 H Part 2. How To Fill Form 15G & 15H Online For PF Withdrawal. While applying PF amount in online at UAN member portal we will get the following message…

5 Amount of *dividend / interest or income in respect of units / withdrawal from National Saving Scheme Account. 6 *Rate at which interest or income in respect of units, as the case may be, is credited / paid.

Tax payers seeking non deduction of tax from certain incomes are required to file a self declaration in Form No. 15G or Form No.15H as per the provisions of Section 197A of the Income-tax Act, 1961.

Change in Estimated income in a FY. You have to declare your estimated income for the concerned FY when you are filling the New Form 15H/15G. After filing these forms, in case you expect that your income is going change in the FY then you need to file Form 15G/15H again with your income providers.

Form No.15G during the same quarter, please allot separate series of serial number for Form No.15H and Form No.15G. 10 The person responsible for paying the income referred to in column 15 of Part I shall not accept the declaration where the amount of income of the nature referred to in section 197A(1C) or the aggregate of the amounts of such income credited or paid or likely to be credited or

mention the total number of such Form No. 15G filed along with the aggregate amount of income for which said declaration(s) have been filed. 8 Mention the distinctive number of shares, account number of term deposit, recurring deposit, National Savings

15G Sample Form es.scribd.com

Download Form 15G & 15H with FAQs TaxGuru

With respect to said notification which will be w.e.f. 1st Jun 2015, please find attached revised Provident Fund (PF) withdrawal Form 19 , PF Form 15G & PF Form 15H which need to submit at the time of sending provident fund claim form to PF authority.

FORM NO. 15G [See section 197A(1C), 197A(1A) and rule 29C] Declaration under section 197A(1) and section 197A (1A) of the Income tax Act, 1961 to be made ‐

If you meet any of the above conditions, kindly send your following duly filled forms (Form 19 & 10C) 1) Name of the Member (in capital letters) The Name should be same as per the PF records .

Change in Estimated income in a FY. You have to declare your estimated income for the concerned FY when you are filling the New Form 15H/15G. After filing these forms, in case you expect that your income is going change in the FY then you need to file Form 15G/15H again with your income providers.

Form 15G:If you are a resident person (other than a company, Co-operative society or a firm), you can submit Form 15G in duplicate to deductor. As per the provisions of section 197A of the Act, Form 15G can be submitted provided the tax on your estimated total income for the financial year computed in accordance with the provisions of the Act is NIL ) and the interest paid or payable to you

FORM NO. 15G [See section 197A(1C), 197A(1A) and rule 29C] Declaration under section 197A(1) and section 197A (1A) of the Income ‐tax Act, 1961 to be made by an individual or Person (not being a …

How to Fill Form 15G & 15H for PF Withdrawal in 2018. Hrcabin.com For example to submit form 15G for SBI fixed deposits login to SBI online portal, in home page click on e-services, there you can find an option to submit form 15G or form 15H.

TDS is deducted at the maximum marginal rate of 34.608% if a member fails to submit PAN or Form 15G or 15H. However, there are certain exceptions to deduction of TDS by EPFO.

Form No.15G. 10 The person responsible for paying the income referred to in column 15 of Part I shall not accept the declaration where the amount of income …

Submitting investment declaration with your employer on time and filling form 15G/15H will save you half the hassles. Investment declarations is a straightforward exercise. However, you cannot randomly submit forms 15G and 15H. There are rules to be aware of.

PF Withdrawal Application (Sample Copy) Money Order Cheque – form 15g for pf withdrawal form 15g for pf withdrawal New format of form 12G and 12H with auto fill facility in excel .. form 15g for pf withdrawal

5 Amount of *dividend / interest or income in respect of units / withdrawal from National Saving Scheme Account. 6 *Rate at which interest or income in respect of units, as the case may be, is credited / paid.

No TDS for PF withdrawals of up to Rs50000 from 1 June

‘FORM NO.15G Declaration under sub-sections (1) and (1A

form no. 15g [See section 197A(1), 197A(1A) and rule 29C] Declaration under section 197A(1) and section 197A (1A) of the Income‐tax Act, 1961 to be made by an individual or Person

new how to fill form 15g for pf withdrawal pdf 14877 15 update everyone filing 15ca Solution to save tds on interest income form 15g and 15h ta. View

10/04/2015 · form to be used by a member of the employees’ pension scheme, 1995 FOR CLAIMING WITHDRAWAL BENEFIT/SCHEME CERTIFICATE (Read the instructions be fore filling up this form)

With respect to said notification which will be w.e.f. 1st Jun 2015, please find attached revised Provident Fund (PF) withdrawal Form 19 , PF Form 15G & PF Form 15H which need to submit at the time of sending provident fund claim form to PF authority.

epfo pdf to downloads kindly beware of the fake websites that are flashing wrong information about epfo. https://www.epfindia.gov.in is the only official website of epfo.

Form 15H & 15G TDS for Senior Citizens & PF Withdrawal

NEW HOW TO FILL UP FORM 19 AND 10C

With respect to said notification which will be w.e.f. 1st Jun 2015, please find attached revised Provident Fund (PF) withdrawal Form 19 , PF Form 15G & PF Form 15H which need to submit at the time of sending provident fund claim form to PF authority.

click here to know how to fill PF Form 15G Sample Filled Form 15G / How To Fill PF Form 15G 1st January 2017 From India, Hyderabad # hareesh-ch. I have found sample filled form 15G here and you can use same for PF withdrawal etc. How To Fill Form 15G For SBI Fixed Deposits To Avoid TDS 11th May 2018 From India, Nirmal. Reply (Add What You Know) Start New Discussion. Cite.Co – is a …

Form No.15G. 10 The person responsible for paying the income referred to in column 15 of Part I shall not accept the declaration where the amount of income …

epfo pdf to downloads kindly beware of the fake websites that are flashing wrong information about epfo. https://www.epfindia.gov.in is the only official website of epfo.

Sample Filled Form 15G & 15H for PF Withdrawal in 2019. Hrcabin.com So for online PF withdrawal claims there is no need to submit separate form 15G, a verified PAN number will be enough to withdraw PF …

If you meet any of the above conditions, kindly send your following duly filled forms (Form 19 & 10C) 1) Name of the Member (in capital letters) The Name should be same as per the PF records .

• Form Nos. 15G and 15H cannot be accepted if amount of withdrawal is more than Rs. 2,50,000/- and Rs. 3,00,000/- respectively. • If TDS is not applicable then it does not mean that the EPF withdrawals are not taxable.

Form 15G in Excel / Fillable PDF. you can submit form 15H,. Click / Tap here to accept the above terms and conditions for free download and personal use of the. Click / Tap here to accept the above terms and conditions for free download and personal use of the.

Submitting investment declaration with your employer on time and filling form 15G/15H will save you half the hassles. Investment declarations is a straightforward exercise. However, you cannot randomly submit forms 15G and 15H. There are rules to be aware of.

30/06/2013 · Filling the form can be a herculean task ,if one is not aware of the the terminologies surrounding the form .Let’s try and simplify .Well ,the first few …

FORM NO. 15H [See section 197A(1C) and rule 29C

Form 15G/H For EPF Withdrawal CiteHR

Form 15H is an undertaking, to avoid TDS, that your taxable income for that year is well within the basic exemption limit and there is no tax liability.We use Form 15H and 15G for PF withdrawal. 15H for Senior Citizens and 15G for people less than 60 Years of age & that is the difference between Form 15G and Form …

PF Form 19 – Free download as PDF File (.pdf), Text File (.txt) or read online for free.

Pdf an ontology of form pf instructions largepr. View. Sec adopts private fund reporting rules and form pf 000036872 1 3edfa5d6e48c0708d80623671d9. View. Form pf and hedge funds risk measurement precision for opt. View . Pf withdrawal process by filling composite claim form on non aadhar adopting release maxresde. View. The impact of form pf to private fund investment managers novembe. View

If you meet any of the above conditions, kindly send your following duly filled forms (Form 19 & 10C) 1) Name of the Member (in capital letters) The Name should be same as per the PF records .

click here to know how to fill PF Form 15G Sample Filled Form 15G / How To Fill PF Form 15G 1st January 2017 From India, Hyderabad # hareesh-ch. I have found sample filled form 15G here and you can use same for PF withdrawal etc. How To Fill Form 15G For SBI Fixed Deposits To Avoid TDS 11th May 2018 From India, Nirmal. Reply (Add What You Know) Start New Discussion. Cite.Co – is a …

Form 15G in Excel / Fillable PDF. you can submit form 15H,. Click / Tap here to accept the above terms and conditions for free download and personal use of the. Click / Tap here to accept the above terms and conditions for free download and personal use of the.

27/04/2015 · Do you need help in filling the form 19 and form 10 as part of employee provident fund (EPF) withdrawal process? below sample filled forms can be helpful.

Search Results: pf withdrawal form filled sample . Sample Filled EPF Form 10c . Please find attached Forms 10D and 20 with another file of Form 20 with instructions to filled up. Employees Provident Fund Scheme. Form 20. Employees’ Provident Funds Scheme, 1952 Form to be used : (1) by guardian of minor/lunatic member. (2) By a nominee or legal heir of the deceased member. Or, (3) …

Form No.15G during the same quarter, please allot separate series of serial number for Form No.15H and Form No.15G. 10 The person responsible for paying the income referred to in column 15 of Part I shall not accept the declaration where the amount of income of the nature referred to in section 197A(1C) or the aggregate of the amounts of such income credited or paid or likely to be credited or

EPF FORM 19. In the Employees Provident Fund, the Form 19 will give their members the flexibility to withdraw their PF Balance even after they quit their job, at …

FORM NO. 15H claiming certain incomes without deduction of

Form 15g sample pdf” Keyword Found Websites Listing

1) Is Form 15G/H required while filling EPF withdrawal form? A. EPF withdrawal is exempted from tax if withdrawn after a service period of 5 years. However, if the withdrawal is made before the completion of 5 years, the member has to pay tax on the withdrawn amount.

15G Sample Form – Free download as PDF File (.pdf) or read online for free. 15G Sample Form

click here to know how to fill PF Form 15G Sample Filled Form 15G / How To Fill PF Form 15G 1st January 2017 From India, Hyderabad # hareesh-ch. I have found sample filled form 15G here and you can use same for PF withdrawal etc. How To Fill Form 15G For SBI Fixed Deposits To Avoid TDS 11th May 2018 From India, Nirmal. Reply (Add What You Know) Start New Discussion. Cite.Co – is a …

Form No.15G. 10 The person responsible for paying the income referred to in column 15 of Part I shall not accept the declaration where the amount of income …

how to fill up form 19 and 10c tags : Please ensure to fill all the required fields in Form 19 correctly to , PF withdrawal process Form 19 (EPF) & Form 10C (EPS) , PF withdrawal process Form 19 (EPF) & Form 10C (EPS) , How to fill: Sample Form 10C , how to fill sample form 10c how to fill sample form 10c , Sample Filled Form 10c Pdf Fill

Submitting investment declaration with your employer on time and filling form 15G/15H will save you half the hassles. Investment declarations is a straightforward exercise. However, you cannot randomly submit forms 15G and 15H. There are rules to be aware of.

PF Withdrawal Application (Sample Copy) Money Order Cheque – form 15g for pf withdrawal form 15g for pf withdrawal New format of form 12G and 12H with auto fill facility in excel .. form 15g for pf withdrawal

FORM NO. 15G Succinct FP

EPF Withdrawal How to Fill PF Withdrawal Form and Getting

Form 15G in Excel / Fillable PDF. you can submit form 15H,. Click / Tap here to accept the above terms and conditions for free download and personal use of the. Click / Tap here to accept the above terms and conditions for free download and personal use of the.

Tax payers seeking non deduction of tax from certain incomes are required to file a self declaration in Form No. 15G or Form No.15H as per the provisions of Section 197A of the Income-tax Act, 1961.

Change in Estimated income in a FY. You have to declare your estimated income for the concerned FY when you are filling the New Form 15H/15G. After filing these forms, in case you expect that your income is going change in the FY then you need to file Form 15G/15H again with your income providers.

• Form Nos. 15G and 15H cannot be accepted if amount of withdrawal is more than Rs. 2,50,000/- and Rs. 3,00,000/- respectively. • If TDS is not applicable then it does not mean that the EPF withdrawals are not taxable.

How to Fill Form 15G & 15H for PF Withdrawal in 2018. Hrcabin.com For example to submit form 15G for SBI fixed deposits login to SBI online portal, in home page click on e-services, there you can find an option to submit form 15G or form 15H.

Sample Filled Form 15G & 15H for PF Withdrawal in 2019. Hrcabin.com So for online PF withdrawal claims there is no need to submit separate form 15G, a verified PAN number will be enough to withdraw PF …

FORM NO. 15G [See section 197A(1C), 197A(1A) and rule 29C] Declaration under section 197A(1) and section 197A (1A) of the Income tax Act, 1961 to be made ‐

PF Withdrawal Application (Sample Copy) Money Order Cheque – form 15g for pf withdrawal form 15g for pf withdrawal New format of form 12G and 12H with auto fill facility in excel .. form 15g for pf withdrawal

form no. 15g [See section 197A(1), 197A(1A) and rule 29C] Declaration under section 197A(1) and section 197A (1A) of the Income‐tax Act, 1961 to be made by an individual or Person

Sample Filled Form 15H in 2019. Filled Form 15H Part 1. Filled Form 15 H Part 2. How To Fill Form 15G & 15H Online For PF Withdrawal. While applying PF amount in online at UAN member portal we will get the following message…

How to fill Form 10C? The Form 10C is available in the pdf format in the above-given link. The form is a 4-page document in which you are required to fill up the first 2 pages in general cases, and the 3rd page has to be filled only if you have taken any advances which are against the account.

Form 15G and Form 15H Comprehensive Guide – TaxAdda

PF Form 19 pt.scribd.com

form no. 15g [See section 197A(1), 197A(1A) and rule 29C] Declaration under section 197A(1) and section 197A (1A) of the Income‐tax Act, 1961 to be made by an individual or Person

Now my HR is asking me to fill up form 15G to get my provident fund. In this case what are all the details I need to fill in 15G form. What are the columns I can leave without filling up. In this case what are all the details I need to fill in 15G form.

mention the total number of such Form No. 15G filed along with the aggregate amount of income for which said declaration(s) have been filed. 8 Mention the distinctive number of shares, account number of term deposit, recurring deposit, National Savings

How to Fill Form 15G & 15H for PF Withdrawal in 2018. Hrcabin.com For example to submit form 15G for SBI fixed deposits login to SBI online portal, in home page click on e-services, there you can find an option to submit form 15G or form 15H.

FORM NO. 15G [See section 197A(1C), 197A(1A) and rule 29C] Declaration under section 197A(1) and section 197A (1A) of the Income tax Act, 1961 to be made ‐

Pdf an ontology of form pf instructions largepr. View. Sec adopts private fund reporting rules and form pf 000036872 1 3edfa5d6e48c0708d80623671d9. View. Form pf and hedge funds risk measurement precision for opt. View . Pf withdrawal process by filling composite claim form on non aadhar adopting release maxresde. View. The impact of form pf to private fund investment managers novembe. View

Form No.15G during the same quarter, please allot separate series of serial number for Form No.15H and Form No.15G. 10 The person responsible for paying the income referred to in column 15 of Part I shall not accept the

Form 15G in Excel / Fillable PDF. you can submit form 15H,. Click / Tap here to accept the above terms and conditions for free download and personal use of the. Click / Tap here to accept the above terms and conditions for free download and personal use of the.

how to fill up form 19 and 10c tags : Please ensure to fill all the required fields in Form 19 correctly to , PF withdrawal process Form 19 (EPF) & Form 10C (EPS) , PF withdrawal process Form 19 (EPF) & Form 10C (EPS) , How to fill: Sample Form 10C , how to fill sample form 10c how to fill sample form 10c , Sample Filled Form 10c Pdf Fill

With respect to said notification which will be w.e.f. 1st Jun 2015, please find attached revised Provident Fund (PF) withdrawal Form 19 , PF Form 15G & PF Form 15H which need to submit at the time of sending provident fund claim form to PF authority.

Submitting investment declaration with your employer on time and filling form 15G/15H will save you half the hassles. Investment declarations is a straightforward exercise. However, you cannot randomly submit forms 15G and 15H. There are rules to be aware of.

27/04/2015 · Do you need help in filling the form 19 and form 10 as part of employee provident fund (EPF) withdrawal process? below sample filled forms can be helpful.

PF Withdrawal Application (Sample Copy) Money Order Cheque – form 15g for pf withdrawal form 15g for pf withdrawal New format of form 12G and 12H with auto fill facility in excel .. form 15g for pf withdrawal

Change in Estimated income in a FY. You have to declare your estimated income for the concerned FY when you are filling the New Form 15H/15G. After filing these forms, in case you expect that your income is going change in the FY then you need to file Form 15G/15H again with your income providers.

No TDS for PF withdrawals of up to Rs50000 from 1 June

NEW HOW TO FILL UP FORM 19 AND 10C

‘form no.15g *#that the securities or sums, particulars of which are given in Schedule II or Schedule III or Schedule IV below, stand in *my/our name and beneficially belong to *me/us, and the *interest in respect of such securities or

mention the total number of such Form No. 15G filed along with the aggregate amount of income for which said declaration(s) have been filed. 8 Mention the distinctive number of shares, account number of term deposit, recurring deposit, National Savings

how to fill up form 19 and 10c tags : Please ensure to fill all the required fields in Form 19 correctly to , PF withdrawal process Form 19 (EPF) & Form 10C (EPS) , PF withdrawal process Form 19 (EPF) & Form 10C (EPS) , How to fill: Sample Form 10C , how to fill sample form 10c how to fill sample form 10c , Sample Filled Form 10c Pdf Fill

5 Amount of *dividend / interest or income in respect of units / withdrawal from National Saving Scheme Account. 6 *Rate at which interest or income in respect of units, as the case may be, is credited / paid.

10/04/2015 · form to be used by a member of the employees’ pension scheme, 1995 FOR CLAIMING WITHDRAWAL BENEFIT/SCHEME CERTIFICATE (Read the instructions be fore filling up this form)

19/04/2015 · ( information to be furnish ed by the Employer if the Claim Form is Attested by the Employer) Certified that the above contributions have been included in the regular monthly remittances.

Submitting investment declaration with your employer on time and filling form 15G/15H will save you half the hassles. Investment declarations is a straightforward exercise. However, you cannot randomly submit forms 15G and 15H. There are rules to be aware of.

Form 15G or 15H can also be filed for TDS on EPF withdrawal, income form corporate bonds, post office deposits and insurance commission under section 194D. Form 15G/15H can also be filed for TDS on rent under section 194I from financial year 2016-17.

FORM No. 15G TDSMAN Blog

No TDS for PF withdrawals of up to Rs50000 from 1 June

Form No.15G. 10 The person responsible for paying the income referred to in column 15 of Part I shall not accept the declaration where the amount of income …

FORM NO. 15G [See section 197A(1C), 197A(1A) and rule 29C] Declaration under section 197A(1) and section 197A (1A) of the Income ‐tax Act, 1961 to be made by an individual or Person (not being a …

15G Sample Form – Free download as PDF File (.pdf) or read online for free. 15G Sample Form

Search Results: pf withdrawal form filled sample . Sample Filled EPF Form 10c . Please find attached Forms 10D and 20 with another file of Form 20 with instructions to filled up. Employees Provident Fund Scheme. Form 20. Employees’ Provident Funds Scheme, 1952 Form to be used : (1) by guardian of minor/lunatic member. (2) By a nominee or legal heir of the deceased member. Or, (3) …

How to Fill Form 15G & 15H for PF Withdrawal in 2018. Hrcabin.com For example to submit form 15G for SBI fixed deposits login to SBI online portal, in home page click on e-services, there you can find an option to submit form 15G or form 15H.

PF Withdrawal Application (Sample Copy) Money Order Cheque – form 15g for pf withdrawal form 15g for pf withdrawal New format of form 12G and 12H with auto fill facility in excel .. form 15g for pf withdrawal

new how to fill form 15g for pf withdrawal pdf 14877 15 update everyone filing 15ca Solution to save tds on interest income form 15g and 15h ta. View

Now my HR is asking me to fill up form 15G to get my provident fund. In this case what are all the details I need to fill in 15G form. What are the columns I can leave without filling up. In this case what are all the details I need to fill in 15G form.

Form 15G:If you are a resident person (other than a company, Co-operative society or a firm), you can submit Form 15G in duplicate to deductor. As per the provisions of section 197A of the Act, Form 15G can be submitted provided the tax on your estimated total income for the financial year computed in accordance with the provisions of the Act is NIL ) and the interest paid or payable to you

EPF FORM 19. In the Employees Provident Fund, the Form 19 will give their members the flexibility to withdraw their PF Balance even after they quit their job, at …

27/04/2015 · Do you need help in filling the form 19 and form 10 as part of employee provident fund (EPF) withdrawal process? below sample filled forms can be helpful.

FORM NO. 15H [See section 197A(1C) and rule 29C

Form 15H & 15G TDS for Senior Citizens & PF Withdrawal

FORM NO. 15G [See section 197A(1C), 197A(1A) and rule 29C] Declaration under section 197A(1) and section 197A (1A) of the Income ‐tax Act, 1961 to be made by an individual or Person (not being a …

Download >> Download 15g form pf instructions. Read Online >> Read Online 15g form pf instructions….. form 15g part 2 filled sample. form 16 for pf withdrawal

Form 15G in Excel / Fillable PDF. you can submit form 15H,. Click / Tap here to accept the above terms and conditions for free download and personal use of the. Click / Tap here to accept the above terms and conditions for free download and personal use of the.

Change in Estimated income in a FY. You have to declare your estimated income for the concerned FY when you are filling the New Form 15H/15G. After filing these forms, in case you expect that your income is going change in the FY then you need to file Form 15G/15H again with your income providers.

Sample Filled Form 15G & 15H for PF Withdrawal in 2019. Hrcabin.com So for online PF withdrawal claims there is no need to submit separate form 15G, a verified PAN number will be enough to withdraw PF …

Tax payers seeking non deduction of tax from certain incomes are required to file a self declaration in Form No. 15G or Form No.15H as per the provisions of Section 197A of the Income-tax Act, 1961.

Now my HR is asking me to fill up form 15G to get my provident fund. In this case what are all the details I need to fill in 15G form. What are the columns I can leave without filling up. In this case what are all the details I need to fill in 15G form.

10/04/2015 · form to be used by a member of the employees’ pension scheme, 1995 FOR CLAIMING WITHDRAWAL BENEFIT/SCHEME CERTIFICATE (Read the instructions be fore filling up this form)

Sample Filled Form 15H in 2019. Filled Form 15H Part 1. Filled Form 15 H Part 2. How To Fill Form 15G & 15H Online For PF Withdrawal. While applying PF amount in online at UAN member portal we will get the following message…

new how to fill form 15g for pf withdrawal pdf 14877 15 update everyone filing 15ca Solution to save tds on interest income form 15g and 15h ta. View

5 Amount of *dividend / interest or income in respect of units / withdrawal from National Saving Scheme Account. 6 *Rate at which interest or income in respect of units, as the case may be, is credited / paid.