New pf withdrawal form 19 pdf

www.epfindia.gov.in Employees’ Provident Fund Scheme, 1952 Form – 19 (UAN) (Applicable in cases where employee’s complete details in Form 11 (New), Aadhaar Number and Bank

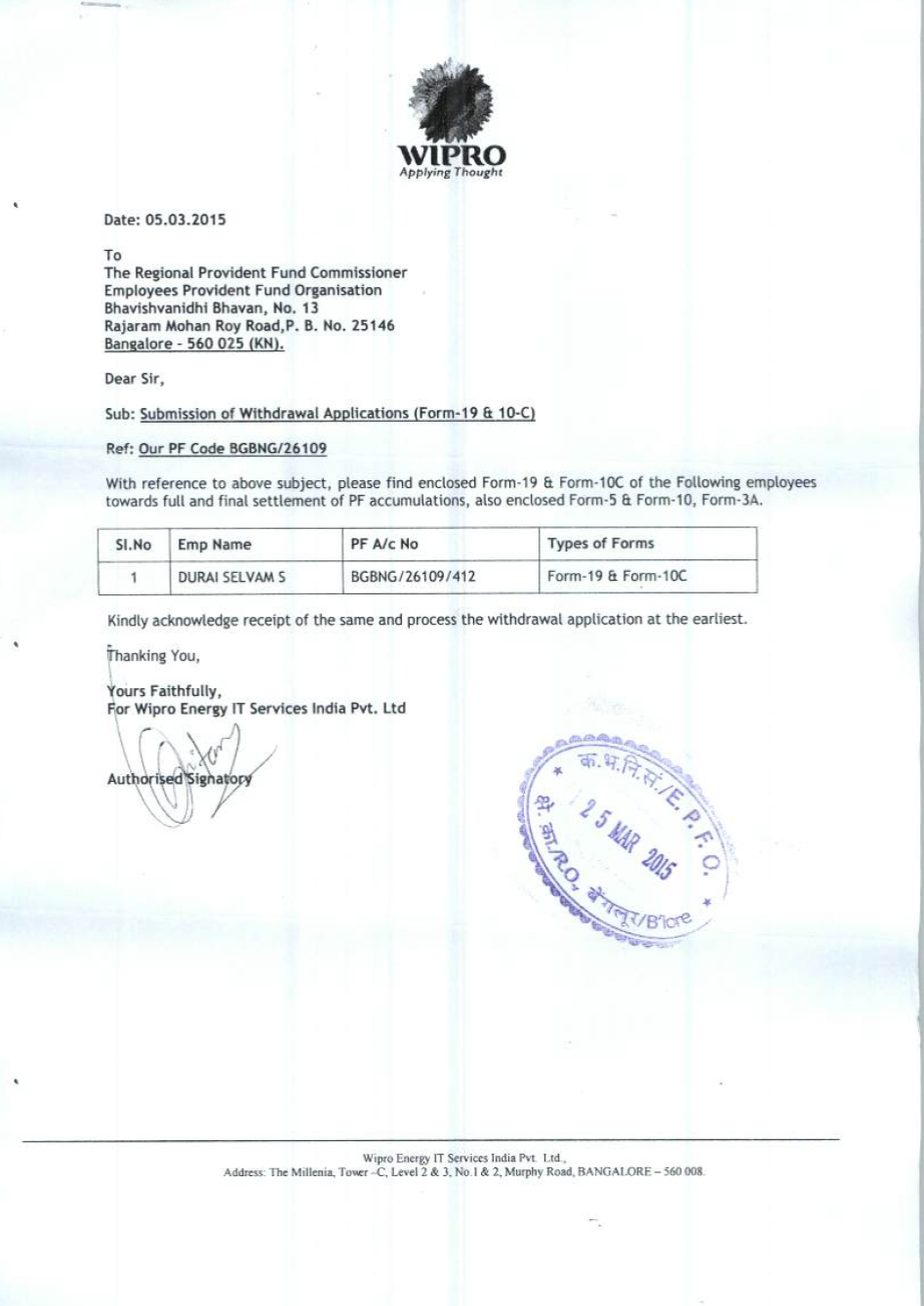

Previously, you had to fill up form 19 for complete withdrawal, form 10C for pension fund scheme certificate to retain membership of Employees’ Pension Scheme or to claim withdrawals, and form

Form 19: EPF Form 19 is required to withdraw all your employee provident fund amount. Employees can submit it after leaving or changing your service or retirement or termination.

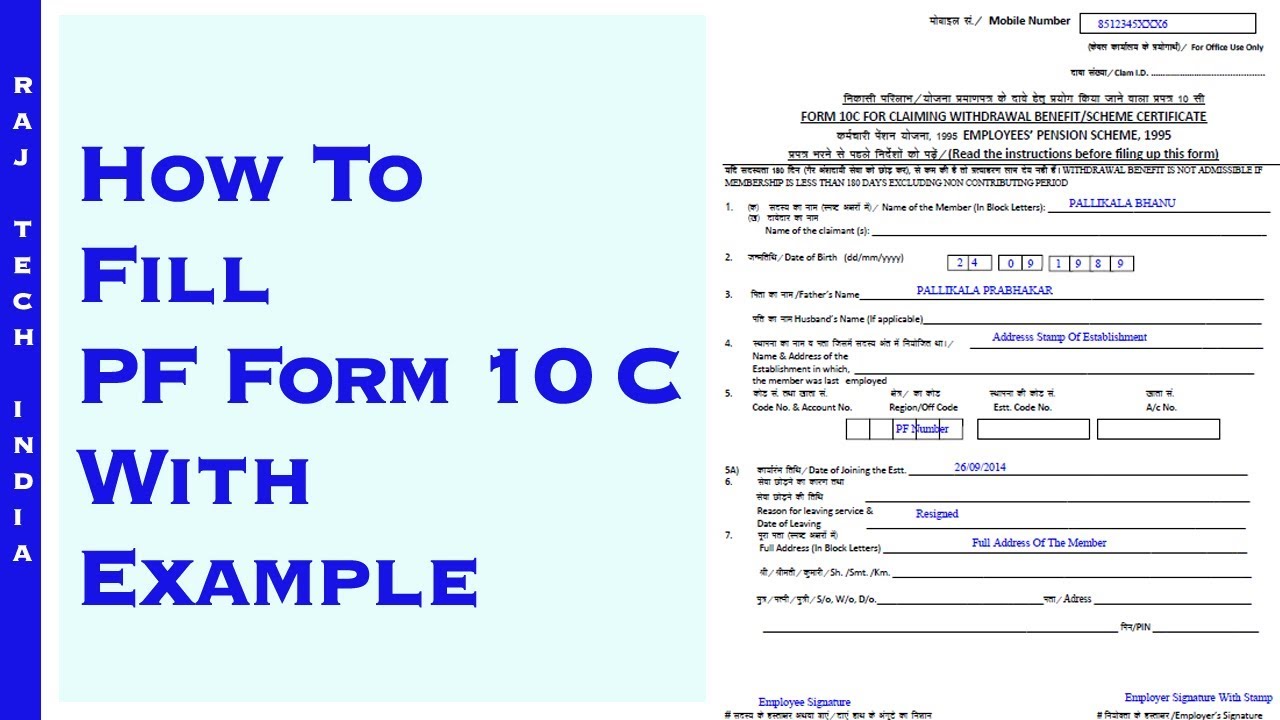

Form 10-C Download – Provident Fund Form 10-C is submitted mostly along with F-19/20 for settlement of withdrawal benefit either under old Family Pension Fund (FPF) or new Employees’ Pension Scheme EPS 95 or also for issuance of Scheme certificate for retention of membership (only in case you are less than 58 years old).

View, download and print 19 – Employees Provident Fund Scheme pdf template or form online. 2 Pf Form 19 Templates are collected for any of your needs.

Also, the members/ employees under PF were using EPS/ EPF forms 10C UAN, 19 UAN and 31 UAN, for PF/ Pension withdrawal without attestation by respective employers. These forms were being used by members/ employees under PF whose AADHAAR Number and Bank details have been seeded as KYC and have been duly verified by the employer using digital signature thereof and the details in form No. 11 (new

Pf withdrawal form 19 pdf. Pf withdrawal form 19 and 10c . Pf withdrawal form 19 free download. Pf withdrawal form 19 and 10c download. Pf withdrawal form 19 and 10c free download. Compare Search ( Please select at least 2 keywords ) Most Searched Keywords. Custom cakes by amy 1 . Shingles symptoms mayo 2 . Dr barronian burien 3 . The code of conduct has changed quizlet 4 . Car bill of …

EPF Members must quote PAN in Form No.- 15G / 15H and in Form No. 19 (EPF Withdrawal Form). Members who have rendered continuous service of 5 years or more, including service with former employer, shall not be required to submit PAN and Form No. 15G/15H along with Form No. 19.

In pursuance of provisions of paragraph 72(5) of the Employees’ Provident Funds Scheme, 1952, Central Provident Fund Commissioner, hereby prescribes the new Composite Claim Form (Non-Aadhar) to replace the existing Forms No. 19, 10C & 31 with a view to simplify the submission of claim forms by subscribers. The new Composite Claim Form (Non-Aadhar), enclosed herewith shall be submitted …

Form 19 and 10 c Pf Withdrawal – Download as Word Doc (.doc), PDF File (.pdf), Text File (.txt) or read online. Scribd is the world’s largest social reading and publishing site. Search Search

10/06/2017 · Learn how to fill PF withdrawal form 10c and form 19. Now we can pf amount by filling up these two forms. and also we can download these to forms form 10c and form 19 in …

Individuals who are looking for Provident Fund settlement and withdrawal can apply UAN form 19. Here are simple steps to follow to submit. Here are simple steps to follow to submit. 1.

Form 19 Employees Provident Fund Scheme printable pdf

EPF Withdrawals New rules & Provisions related to TDS

EPFO introduces one page form to ease withdrawals

– iap growth charts 2016 pdf

Epf Form 19 Instructions PDF documents

–

EPF Withdrawals New rules & Provisions related to TDS

New EPF UAN Form 19 How to Withdraw EPF Without Employer

www.epfindia.gov.in Employees’ Provident Fund Scheme, 1952 Form – 19 (UAN) (Applicable in cases where employee’s complete details in Form 11 (New), Aadhaar Number and Bank

Individuals who are looking for Provident Fund settlement and withdrawal can apply UAN form 19. Here are simple steps to follow to submit. Here are simple steps to follow to submit. 1.

Previously, you had to fill up form 19 for complete withdrawal, form 10C for pension fund scheme certificate to retain membership of Employees’ Pension Scheme or to claim withdrawals, and form

Pf withdrawal form 19 pdf. Pf withdrawal form 19 and 10c . Pf withdrawal form 19 free download. Pf withdrawal form 19 and 10c download. Pf withdrawal form 19 and 10c free download. Compare Search ( Please select at least 2 keywords ) Most Searched Keywords. Custom cakes by amy 1 . Shingles symptoms mayo 2 . Dr barronian burien 3 . The code of conduct has changed quizlet 4 . Car bill of …

Form 19: EPF Form 19 is required to withdraw all your employee provident fund amount. Employees can submit it after leaving or changing your service or retirement or termination.

In pursuance of provisions of paragraph 72(5) of the Employees’ Provident Funds Scheme, 1952, Central Provident Fund Commissioner, hereby prescribes the new Composite Claim Form (Non-Aadhar) to replace the existing Forms No. 19, 10C & 31 with a view to simplify the submission of claim forms by subscribers. The new Composite Claim Form (Non-Aadhar), enclosed herewith shall be submitted …

View, download and print 19 – Employees Provident Fund Scheme pdf template or form online. 2 Pf Form 19 Templates are collected for any of your needs.

10/06/2017 · Learn how to fill PF withdrawal form 10c and form 19. Now we can pf amount by filling up these two forms. and also we can download these to forms form 10c and form 19 in …

Also, the members/ employees under PF were using EPS/ EPF forms 10C UAN, 19 UAN and 31 UAN, for PF/ Pension withdrawal without attestation by respective employers. These forms were being used by members/ employees under PF whose AADHAAR Number and Bank details have been seeded as KYC and have been duly verified by the employer using digital signature thereof and the details in form No. 11 (new

Form 19 and 10 c Pf Withdrawal – Download as Word Doc (.doc), PDF File (.pdf), Text File (.txt) or read online. Scribd is the world’s largest social reading and publishing site. Search Search

EPF Members must quote PAN in Form No.- 15G / 15H and in Form No. 19 (EPF Withdrawal Form). Members who have rendered continuous service of 5 years or more, including service with former employer, shall not be required to submit PAN and Form No. 15G/15H along with Form No. 19.

Form 10-C Download – Provident Fund Form 10-C is submitted mostly along with F-19/20 for settlement of withdrawal benefit either under old Family Pension Fund (FPF) or new Employees’ Pension Scheme EPS 95 or also for issuance of Scheme certificate for retention of membership (only in case you are less than 58 years old).

EPF Withdrawals New rules & Provisions related to TDS

Form 19 Employees Provident Fund Scheme printable pdf

In pursuance of provisions of paragraph 72(5) of the Employees’ Provident Funds Scheme, 1952, Central Provident Fund Commissioner, hereby prescribes the new Composite Claim Form (Non-Aadhar) to replace the existing Forms No. 19, 10C & 31 with a view to simplify the submission of claim forms by subscribers. The new Composite Claim Form (Non-Aadhar), enclosed herewith shall be submitted …

Individuals who are looking for Provident Fund settlement and withdrawal can apply UAN form 19. Here are simple steps to follow to submit. Here are simple steps to follow to submit. 1.

Previously, you had to fill up form 19 for complete withdrawal, form 10C for pension fund scheme certificate to retain membership of Employees’ Pension Scheme or to claim withdrawals, and form

www.epfindia.gov.in Employees’ Provident Fund Scheme, 1952 Form – 19 (UAN) (Applicable in cases where employee’s complete details in Form 11 (New), Aadhaar Number and Bank

Form 19: EPF Form 19 is required to withdraw all your employee provident fund amount. Employees can submit it after leaving or changing your service or retirement or termination.

Form 19 and 10 c Pf Withdrawal – Download as Word Doc (.doc), PDF File (.pdf), Text File (.txt) or read online. Scribd is the world’s largest social reading and publishing site. Search Search

Form 10-C Download – Provident Fund Form 10-C is submitted mostly along with F-19/20 for settlement of withdrawal benefit either under old Family Pension Fund (FPF) or new Employees’ Pension Scheme EPS 95 or also for issuance of Scheme certificate for retention of membership (only in case you are less than 58 years old).

EPF Members must quote PAN in Form No.- 15G / 15H and in Form No. 19 (EPF Withdrawal Form). Members who have rendered continuous service of 5 years or more, including service with former employer, shall not be required to submit PAN and Form No. 15G/15H along with Form No. 19.

View, download and print 19 – Employees Provident Fund Scheme pdf template or form online. 2 Pf Form 19 Templates are collected for any of your needs.

EPF Withdrawals New rules & Provisions related to TDS

EPFO introduces one page form to ease withdrawals

www.epfindia.gov.in Employees’ Provident Fund Scheme, 1952 Form – 19 (UAN) (Applicable in cases where employee’s complete details in Form 11 (New), Aadhaar Number and Bank

In pursuance of provisions of paragraph 72(5) of the Employees’ Provident Funds Scheme, 1952, Central Provident Fund Commissioner, hereby prescribes the new Composite Claim Form (Non-Aadhar) to replace the existing Forms No. 19, 10C & 31 with a view to simplify the submission of claim forms by subscribers. The new Composite Claim Form (Non-Aadhar), enclosed herewith shall be submitted …

View, download and print 19 – Employees Provident Fund Scheme pdf template or form online. 2 Pf Form 19 Templates are collected for any of your needs.

Form 19 and 10 c Pf Withdrawal – Download as Word Doc (.doc), PDF File (.pdf), Text File (.txt) or read online. Scribd is the world’s largest social reading and publishing site. Search Search

Individuals who are looking for Provident Fund settlement and withdrawal can apply UAN form 19. Here are simple steps to follow to submit. Here are simple steps to follow to submit. 1.

New EPF UAN Form 19 How to Withdraw EPF Without Employer

Employees’ Provident Fund Scheme 1952 Form 19 (UAN)

EPF Members must quote PAN in Form No.- 15G / 15H and in Form No. 19 (EPF Withdrawal Form). Members who have rendered continuous service of 5 years or more, including service with former employer, shall not be required to submit PAN and Form No. 15G/15H along with Form No. 19.

Pf withdrawal form 19 pdf. Pf withdrawal form 19 and 10c . Pf withdrawal form 19 free download. Pf withdrawal form 19 and 10c download. Pf withdrawal form 19 and 10c free download. Compare Search ( Please select at least 2 keywords ) Most Searched Keywords. Custom cakes by amy 1 . Shingles symptoms mayo 2 . Dr barronian burien 3 . The code of conduct has changed quizlet 4 . Car bill of …

10/06/2017 · Learn how to fill PF withdrawal form 10c and form 19. Now we can pf amount by filling up these two forms. and also we can download these to forms form 10c and form 19 in …

Form 19 and 10 c Pf Withdrawal – Download as Word Doc (.doc), PDF File (.pdf), Text File (.txt) or read online. Scribd is the world’s largest social reading and publishing site. Search Search

Form 19: EPF Form 19 is required to withdraw all your employee provident fund amount. Employees can submit it after leaving or changing your service or retirement or termination.

In pursuance of provisions of paragraph 72(5) of the Employees’ Provident Funds Scheme, 1952, Central Provident Fund Commissioner, hereby prescribes the new Composite Claim Form (Non-Aadhar) to replace the existing Forms No. 19, 10C & 31 with a view to simplify the submission of claim forms by subscribers. The new Composite Claim Form (Non-Aadhar), enclosed herewith shall be submitted …

EPF Withdrawals New rules & Provisions related to TDS

Employees’ Provident Fund Scheme 1952 Form 19 (UAN)

Individuals who are looking for Provident Fund settlement and withdrawal can apply UAN form 19. Here are simple steps to follow to submit. Here are simple steps to follow to submit. 1.

Pf withdrawal form 19 pdf. Pf withdrawal form 19 and 10c . Pf withdrawal form 19 free download. Pf withdrawal form 19 and 10c download. Pf withdrawal form 19 and 10c free download. Compare Search ( Please select at least 2 keywords ) Most Searched Keywords. Custom cakes by amy 1 . Shingles symptoms mayo 2 . Dr barronian burien 3 . The code of conduct has changed quizlet 4 . Car bill of …

www.epfindia.gov.in Employees’ Provident Fund Scheme, 1952 Form – 19 (UAN) (Applicable in cases where employee’s complete details in Form 11 (New), Aadhaar Number and Bank

Form 19 and 10 c Pf Withdrawal – Download as Word Doc (.doc), PDF File (.pdf), Text File (.txt) or read online. Scribd is the world’s largest social reading and publishing site. Search Search

Previously, you had to fill up form 19 for complete withdrawal, form 10C for pension fund scheme certificate to retain membership of Employees’ Pension Scheme or to claim withdrawals, and form

In pursuance of provisions of paragraph 72(5) of the Employees’ Provident Funds Scheme, 1952, Central Provident Fund Commissioner, hereby prescribes the new Composite Claim Form (Non-Aadhar) to replace the existing Forms No. 19, 10C & 31 with a view to simplify the submission of claim forms by subscribers. The new Composite Claim Form (Non-Aadhar), enclosed herewith shall be submitted …

View, download and print 19 – Employees Provident Fund Scheme pdf template or form online. 2 Pf Form 19 Templates are collected for any of your needs.

Form 10-C Download – Provident Fund Form 10-C is submitted mostly along with F-19/20 for settlement of withdrawal benefit either under old Family Pension Fund (FPF) or new Employees’ Pension Scheme EPS 95 or also for issuance of Scheme certificate for retention of membership (only in case you are less than 58 years old).

10/06/2017 · Learn how to fill PF withdrawal form 10c and form 19. Now we can pf amount by filling up these two forms. and also we can download these to forms form 10c and form 19 in …

EPF Members must quote PAN in Form No.- 15G / 15H and in Form No. 19 (EPF Withdrawal Form). Members who have rendered continuous service of 5 years or more, including service with former employer, shall not be required to submit PAN and Form No. 15G/15H along with Form No. 19.

Employees’ Provident Fund Scheme 1952 Form 19 (UAN)

EPFO introduces one page form to ease withdrawals

Individuals who are looking for Provident Fund settlement and withdrawal can apply UAN form 19. Here are simple steps to follow to submit. Here are simple steps to follow to submit. 1.

www.epfindia.gov.in Employees’ Provident Fund Scheme, 1952 Form – 19 (UAN) (Applicable in cases where employee’s complete details in Form 11 (New), Aadhaar Number and Bank

Pf withdrawal form 19 pdf. Pf withdrawal form 19 and 10c . Pf withdrawal form 19 free download. Pf withdrawal form 19 and 10c download. Pf withdrawal form 19 and 10c free download. Compare Search ( Please select at least 2 keywords ) Most Searched Keywords. Custom cakes by amy 1 . Shingles symptoms mayo 2 . Dr barronian burien 3 . The code of conduct has changed quizlet 4 . Car bill of …

Form 10-C Download – Provident Fund Form 10-C is submitted mostly along with F-19/20 for settlement of withdrawal benefit either under old Family Pension Fund (FPF) or new Employees’ Pension Scheme EPS 95 or also for issuance of Scheme certificate for retention of membership (only in case you are less than 58 years old).

EPF Members must quote PAN in Form No.- 15G / 15H and in Form No. 19 (EPF Withdrawal Form). Members who have rendered continuous service of 5 years or more, including service with former employer, shall not be required to submit PAN and Form No. 15G/15H along with Form No. 19.

Also, the members/ employees under PF were using EPS/ EPF forms 10C UAN, 19 UAN and 31 UAN, for PF/ Pension withdrawal without attestation by respective employers. These forms were being used by members/ employees under PF whose AADHAAR Number and Bank details have been seeded as KYC and have been duly verified by the employer using digital signature thereof and the details in form No. 11 (new

Previously, you had to fill up form 19 for complete withdrawal, form 10C for pension fund scheme certificate to retain membership of Employees’ Pension Scheme or to claim withdrawals, and form

EPF Withdrawals New rules & Provisions related to TDS

New EPF UAN Form 19 How to Withdraw EPF Without Employer

Form 19: EPF Form 19 is required to withdraw all your employee provident fund amount. Employees can submit it after leaving or changing your service or retirement or termination.

Individuals who are looking for Provident Fund settlement and withdrawal can apply UAN form 19. Here are simple steps to follow to submit. Here are simple steps to follow to submit. 1.

Pf withdrawal form 19 pdf. Pf withdrawal form 19 and 10c . Pf withdrawal form 19 free download. Pf withdrawal form 19 and 10c download. Pf withdrawal form 19 and 10c free download. Compare Search ( Please select at least 2 keywords ) Most Searched Keywords. Custom cakes by amy 1 . Shingles symptoms mayo 2 . Dr barronian burien 3 . The code of conduct has changed quizlet 4 . Car bill of …

www.epfindia.gov.in Employees’ Provident Fund Scheme, 1952 Form – 19 (UAN) (Applicable in cases where employee’s complete details in Form 11 (New), Aadhaar Number and Bank

Also, the members/ employees under PF were using EPS/ EPF forms 10C UAN, 19 UAN and 31 UAN, for PF/ Pension withdrawal without attestation by respective employers. These forms were being used by members/ employees under PF whose AADHAAR Number and Bank details have been seeded as KYC and have been duly verified by the employer using digital signature thereof and the details in form No. 11 (new

Previously, you had to fill up form 19 for complete withdrawal, form 10C for pension fund scheme certificate to retain membership of Employees’ Pension Scheme or to claim withdrawals, and form

View, download and print 19 – Employees Provident Fund Scheme pdf template or form online. 2 Pf Form 19 Templates are collected for any of your needs.

Form 10-C Download – Provident Fund Form 10-C is submitted mostly along with F-19/20 for settlement of withdrawal benefit either under old Family Pension Fund (FPF) or new Employees’ Pension Scheme EPS 95 or also for issuance of Scheme certificate for retention of membership (only in case you are less than 58 years old).

EPF Members must quote PAN in Form No.- 15G / 15H and in Form No. 19 (EPF Withdrawal Form). Members who have rendered continuous service of 5 years or more, including service with former employer, shall not be required to submit PAN and Form No. 15G/15H along with Form No. 19.

10/06/2017 · Learn how to fill PF withdrawal form 10c and form 19. Now we can pf amount by filling up these two forms. and also we can download these to forms form 10c and form 19 in …

Form 19 and 10 c Pf Withdrawal – Download as Word Doc (.doc), PDF File (.pdf), Text File (.txt) or read online. Scribd is the world’s largest social reading and publishing site. Search Search

In pursuance of provisions of paragraph 72(5) of the Employees’ Provident Funds Scheme, 1952, Central Provident Fund Commissioner, hereby prescribes the new Composite Claim Form (Non-Aadhar) to replace the existing Forms No. 19, 10C & 31 with a view to simplify the submission of claim forms by subscribers. The new Composite Claim Form (Non-Aadhar), enclosed herewith shall be submitted …

EPFO introduces one page form to ease withdrawals

EPF Withdrawals New rules & Provisions related to TDS

EPF Members must quote PAN in Form No.- 15G / 15H and in Form No. 19 (EPF Withdrawal Form). Members who have rendered continuous service of 5 years or more, including service with former employer, shall not be required to submit PAN and Form No. 15G/15H along with Form No. 19.

Pf withdrawal form 19 pdf. Pf withdrawal form 19 and 10c . Pf withdrawal form 19 free download. Pf withdrawal form 19 and 10c download. Pf withdrawal form 19 and 10c free download. Compare Search ( Please select at least 2 keywords ) Most Searched Keywords. Custom cakes by amy 1 . Shingles symptoms mayo 2 . Dr barronian burien 3 . The code of conduct has changed quizlet 4 . Car bill of …

Form 19: EPF Form 19 is required to withdraw all your employee provident fund amount. Employees can submit it after leaving or changing your service or retirement or termination.

In pursuance of provisions of paragraph 72(5) of the Employees’ Provident Funds Scheme, 1952, Central Provident Fund Commissioner, hereby prescribes the new Composite Claim Form (Non-Aadhar) to replace the existing Forms No. 19, 10C & 31 with a view to simplify the submission of claim forms by subscribers. The new Composite Claim Form (Non-Aadhar), enclosed herewith shall be submitted …

Also, the members/ employees under PF were using EPS/ EPF forms 10C UAN, 19 UAN and 31 UAN, for PF/ Pension withdrawal without attestation by respective employers. These forms were being used by members/ employees under PF whose AADHAAR Number and Bank details have been seeded as KYC and have been duly verified by the employer using digital signature thereof and the details in form No. 11 (new

Form 10-C Download – Provident Fund Form 10-C is submitted mostly along with F-19/20 for settlement of withdrawal benefit either under old Family Pension Fund (FPF) or new Employees’ Pension Scheme EPS 95 or also for issuance of Scheme certificate for retention of membership (only in case you are less than 58 years old).

View, download and print 19 – Employees Provident Fund Scheme pdf template or form online. 2 Pf Form 19 Templates are collected for any of your needs.